Wir sind der am besten angebundene Anbieter für die Verification Of Payee

Erreichen Sie Europa, Großbritannien und die gesamte Welt.

Wir sind der am besten angebundene Anbieter für die Verification Of Payee

SurePay bietet vertrauenswürdige Lösungen zur Verifizierung von Zahlungsempfängern und schützt über 170 Millionen Konten in 38 Ländern. Führende Banken und Organisationen in ganz Europa vertrauen auf uns, um ihre Zahlungen zu sichern und Betrug zu verhindern.

Unsere Lösungen

Verification Of Payee für europäische Banken

Ermöglicht es der Bank, VOP-Anfragen zu senden und zu beantworten, mit garantiert 100 % Reichweite in Europa.

European Batch Check

Das Überprüfen von als Paket gelieferten Zahlungsaufträgen ist eine der neuen Schlüsselanforderungen der Verordnung.

SWIFT Beneficiary Account Verification

Erweitern Sie Ihre Reichweite global, indem Sie den von Swift angebotenen Pre-Validation Dienst nutzen.

Einhaltung der Verordnung über Sofortzahlungen

Die Uhr tickt…

Banken werden verpflichtet sein, eine Verification Of Payee umzusetzen. Durch die Implementierung unserer europäischen Verification Of Payee-Lösung erhalten Ihre Kunden eine Benachrichtigung, wenn IBAN und Name nicht übereinstimmen. Mit unserer Lösung können Sie:

- (Inter)nationalen Zahlungsbetrug verhindern

- Fehlgeleitete Zahlungen verhindern

- Betriebskosten & Erstattungen erheblich reduzieren

Belgische Banken wählen SurePay als bevorzugten Anbieter für die Verifizierung von Zahlungsempfängern

Wir haben es uns zur Aufgabe gemacht, sowohl unsere Kunden als auch deren Kunden vor der wachsenden Bedrohung durch Zahlungsbetrug weltweit zu schützen, sowohl grenzüberschreitend als auch national.

– David-Jan Janse, CEO von SurePay

Was unsere Kunden sagen

Häufig gestellte Fragen

Auf Seiten der Bank sind zwei wichtige Dinge zu beachten. Zunächst muss die API, die die Kontonamenverifizierung ermöglicht, in Ihre Online Banking Umgebung integriert werden. Zweitens muss die Datenbereitstellung gewährleistet sein. Dies betrifft die Bereitstellung von Kundendaten durch Ihre Bank an SurePay, damit SurePays Algorithmus die Zahlungsdaten mit den Kundendaten Ihrer Bank abgleichen kann. Weitere Informationen zu den erforderlichen Umsetzungsmaßnahmen finden Sie im Muster-Implementierungsplan.

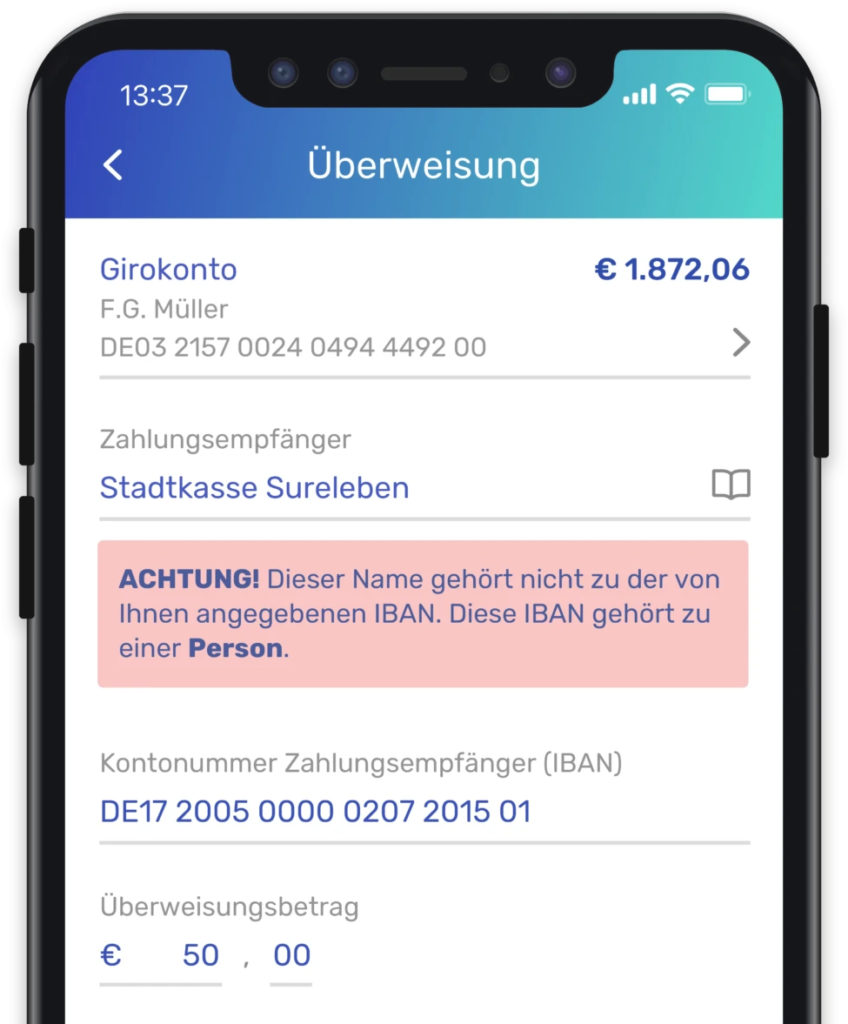

Bei einer Online Überweisung überprüfen die Verification Of Payee, der IBAN-Name Check und die SurePay Confirmation of Payee die eingegebenen Kontodaten des Begünstigten vor der tatsächlichen Überweisung. Die Überprüfung basiert auf der einzigartigen Kombination aus dem Namen des Kontoinhabers und seiner Kontonummer. Die Bank des Zahlers sendet den eingegebenen Kontonamen und die Kontonummer an SurePay. SurePay wiederum gleicht diese Daten mit den verfügbaren Daten ab, um eine Rückmeldung zu geben. Sollten die eingegebenen Daten falsch sein (d.h. der Name des Begünstigten stimmt nicht mit den bei der Bank bekannten Namen für diese Kontonummer überein), erhält der Zahlungsinitiator eine Benachrichtigung. Der Zahler könnte einem Zahlungsbetrug ausgesetzt sein oder möglicherweise einen Fehler gemacht haben. Die Verification Of Payee ist auf den EU-Markt zugeschnitten und die SurePay Confirmation of Payee entspricht den Anforderungen, Regeln und Vorschriften des britischen Marktes.

Sollten die eingegebenen Kontodaten mit den bei der Bank bekannten Informationen für die betreffende Kontonummer übereinstimmen, werden in der Regel keine Benachrichtigungen ausgelöst. Ist dies nicht der Fall, können Sie drei Haupttypen von Benachrichtigungen unterscheiden: Warnung Wenn der eingegebene Name in keiner Weise mit den bei der betreffenden Bank bekannten Kontoinformationen übereinstimmt – zum Beispiel „D. Williams“ statt „K. James“ – wird eine Warnmeldung ausgegeben. Bitte beachten Sie, dass Sie möglicherweise einem Betrug oder einem Fehler ausgesetzt sind. Die Benachrichtigung teilt Ihnen mit, dass der Kontoinhaber bei der betreffenden Bank unter einem anderen Namen registriert ist. Erwägen Sie alternative Maßnahmen oder kontaktieren Sie den Begünstigten, bevor Sie Gelder überweisen. Namensvorschlag Im Falle kleiner Fehler, wie z.B. einem Tippfehler, erhalten Sie einen Namensvorschlag, wie er bei der betreffenden Bank registriert ist. Zum Beispiel „Williams“ statt „Wiliams“. Bitte überprüfen Sie, ob der vorgeschlagene Name zu der Person/Firma gehört, an die Sie Gelder überweisen möchten. Dienst nicht verfügbar SurePay überprüft Kontonummern und deren Informationen in seiner Datenbank. Sollte SurePay nicht in der Lage sein, die Kontodaten mit einer Kontonummer abzugleichen, werden Sie ebenfalls benachrichtigt. Dies kann zum Beispiel bei ausländischen Bankkontonummern auftreten, für die SurePay möglicherweise nicht genügend Informationen zur Verfügung stehen.

Nein, müssen Sie nicht. SurePays Verification Of Payee Service ist keine separate App oder Programm. Ihre eigene Bank kann sich dafür entscheiden, den Kontonamen-Verifizierungsdienst von SurePay in ihre Online Umgebung zu integrieren und ihn Ihnen zur Verfügung zu stellen. Der Dienst funktioniert generell für Online Überweisungen und wird über eine reguläre Banking Anwendung zur Verfügung gestellt. Derzeit stehen die SurePay Dienste den Kunden von über 100 EU-Banken zur Verfügung.

Derzeit ist SurePays Dienst exklusiv für Kunden von über 100 niederländischen, britischen, französischen und italienischen Banken verfügbar: Unternehmen und Organisationen können die Verification Of Payee auch in ihre eigenen Geschäftsprozesse und Systeme implementieren, unabhängig davon, welche Bank sie nutzen.

Bereit loszulegen?

Entdecken Sie die Vorteile unserer Verification Of Payee Lösung

Laden Sie unsere Broschüre zur Überprüfung des Zahlungsempfängers herunter

Unsere Kunden