Verify account details. Risk nothing.

trusted account verification intelligence.

Trusted by 25k organizations

A decade of experience

across payment verification, fraud & AML

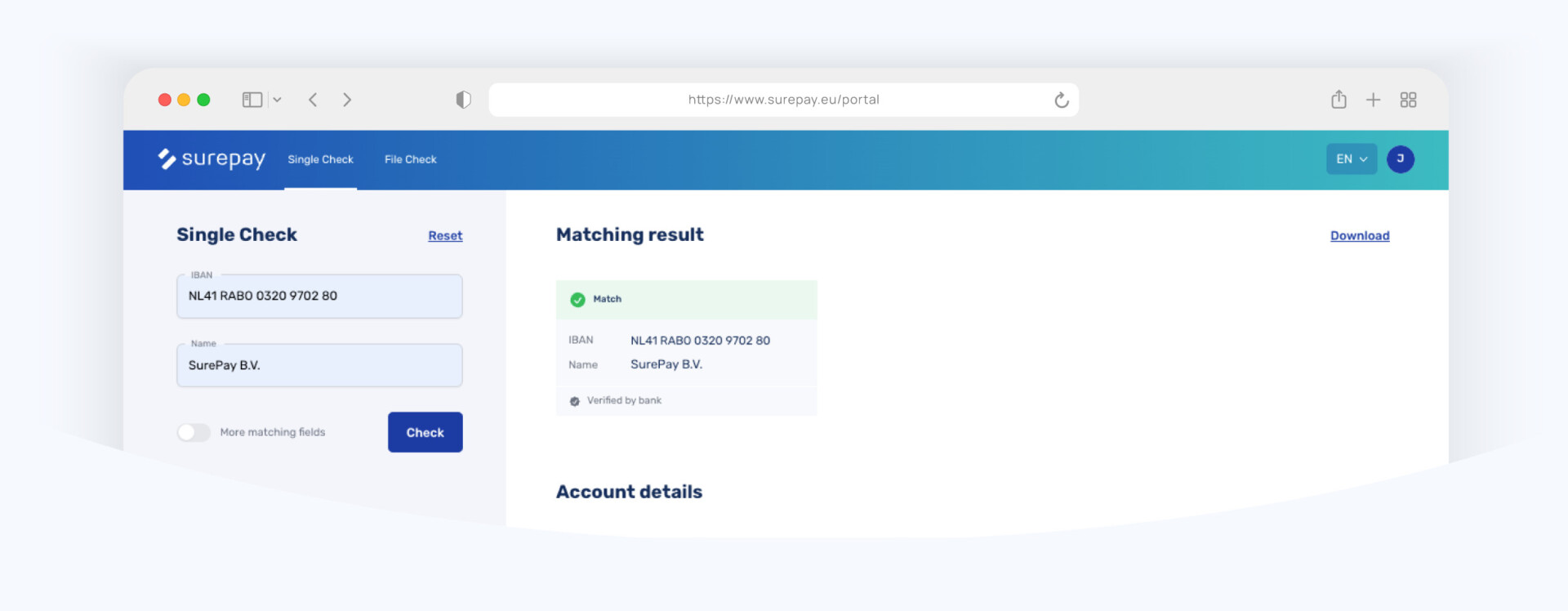

Verification Of Payee (VOP) and Confirmation of Payee (CoP) for Banks & PSPs

Accurate payee verification before payments are executed, embedded in bank and PSP flows, or manually checked via the SurePay Portal

Fraud & Anti Money Laundering Intelligence

Uses verification at scale across banks, PSPs and corporates as shared intelligence to support fraud and AML detection

Account Verification for Corporates

Verify customer and supplier accounts to accelerate onboarding, prevent payment errors, reduce fraud, and support ongoing compliance

Proven at scale

Chosen as the standard by national payment

associations, banks, and corporates.

5.000+ connected banks

and financial institutions

Over 12 billion verification checks processed

Helping 20,000 organizations globally

Active across multiple industries in more than 30 countries

Trusted by the best payment teams

SurePay in action at NatWest

Protecting payments at scale

National Westminster Bank was the first financial institution to go live with Confirmation of Payee, following the Payment System Regulator’s mandate in the UK. In this customer story, learn how National Westminster Bank uses SurePay to reduce APP fraud and prevent payment errors at scale, performing over 750,000 verification checks per day.

Start today. Be sure who you pay.