Verification of Payee API

One Connection for European Coverage

Seamless integration

Comply with Instant Payments Legislation & PSD3

Tailored VoP solution for European Banks & PSPs

Prevent APP fraud & lower operational costs

How does it work?

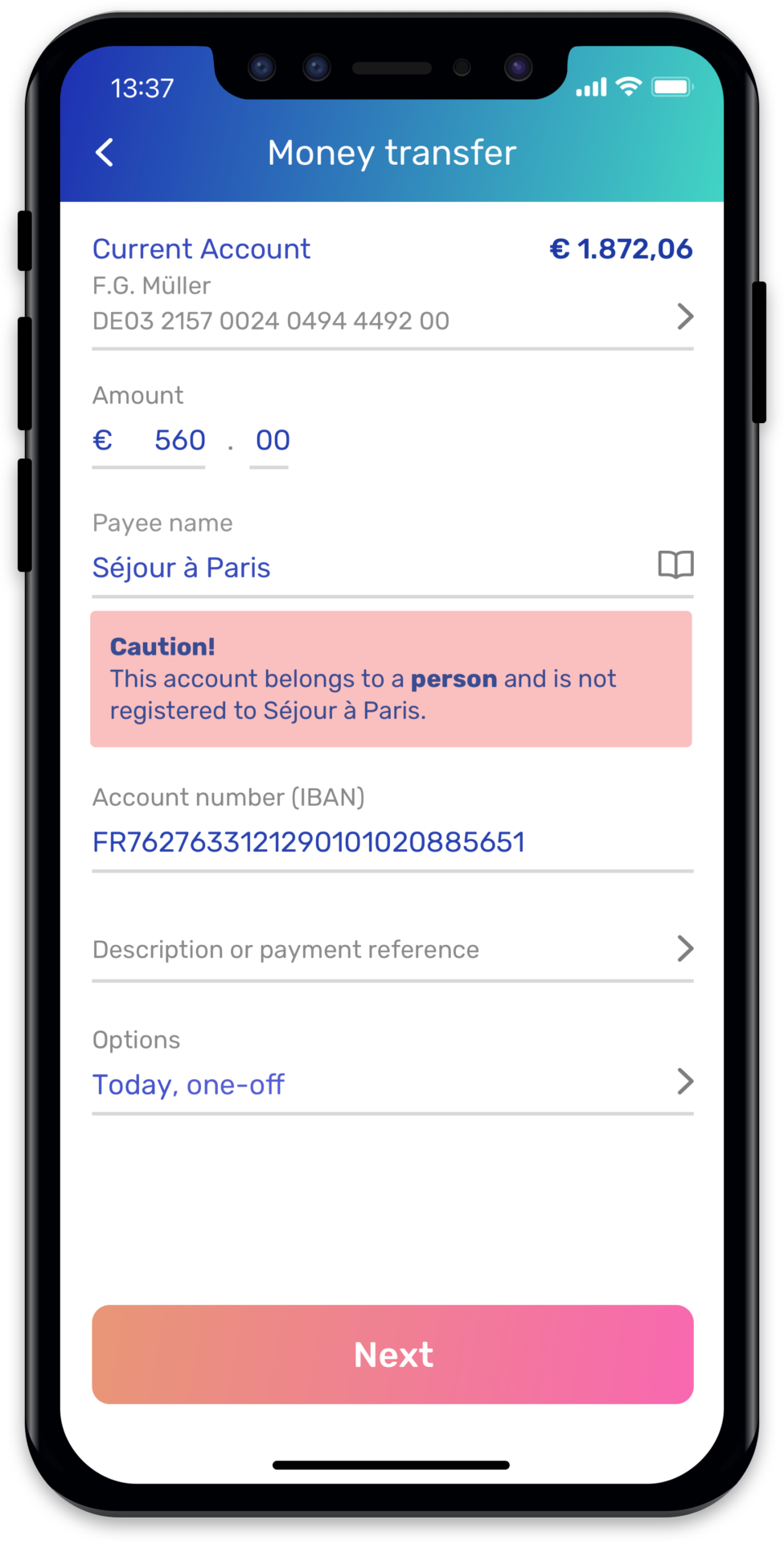

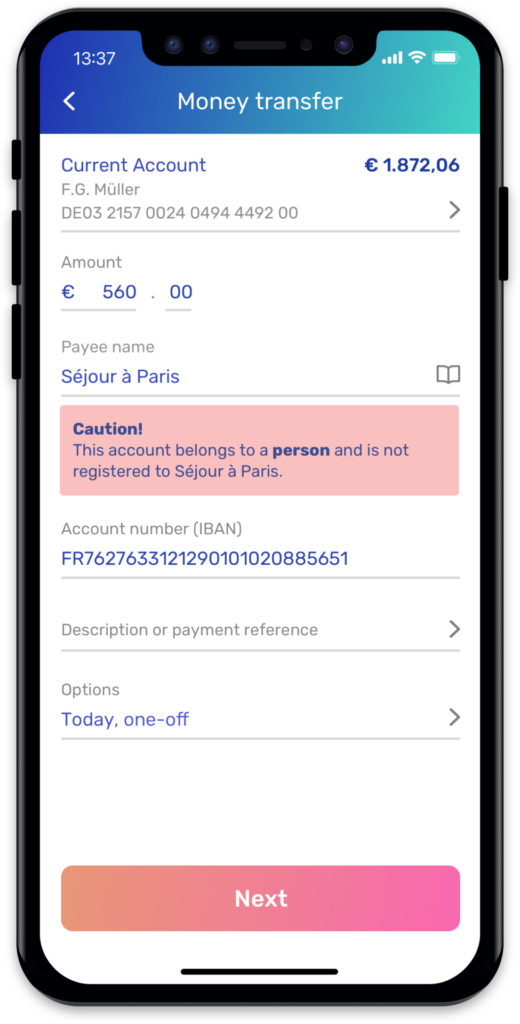

When making a transfer online, Verification of Payee verifies the entered account details of the beneficiary prior to the actual transfer. When implemented, customers receive either one of the following matching results:

- Match: The entered IBAN and Name match. A notification is shown to your customer indicating that the entered details are correct.

- Close match: the name entered differs slightly from the name that belongs to the entered IBAN. The customer receives a notification with a clickable name suggestion. When clicked, the name is automatically corrected.

- No match: the name entered does not match the entered IBAN. The customer receives an error notification and can cancel the payment to check the data.

Banks decide which notification is displayed to customers

Verification of Payee Add-ons

SWIFT Pre-Validation Service

Expand your reach on a global scale by leveraging the pre-validation service offered by Swift. SurePay is an official Enabler partner of Swift and can take banks from local Confirmation of Payee to to EU and beyond to Global.

Trust in a secure and accredited platform for a frictionless and fraud-resistant financial experience.

Read More →

Read More →

European Batch Check

Are you ready to meet the requirements of the Instant Payments regulation? Checking payment orders delivered as a package is one of the new key requirements of the regulation. SurePay has multiple solutions available to suit your needs and meet the requirements to comply with the regulation.

Read More →

Read More →

Fraud Risk Indicator

The Fraud Risk Indicator provides additional data points; risk indicators that will help the bank to determine whether there’s an increased risk or a decreased risk of fraud.

Read More →

Read More →

Switch Check

If a bank uses the SurePay Switch Check, the payer will be notified when the payee has switched to another bank. This way he can immediately pay to the new IBAN and update his address book. This speeds up the adoption of new account numbers.

Read More →

Read More →

PayID

With SurePay PayID customers can now easily and securely pay in your Banking App to friends and acquaintances on their contact list. In the future we will add more identification options to this service. SurePay PayID uses the smart Verification of Payee algorithm for this.

Read More →

Read More →

As the inventor and pioneer of the Verification of Payee solution, SurePay’s experience and technical expertise in rolling out our technology across the EU puts us in a position to offer a quick, frictionless, and best-in-class implementation for regulated financial institutions.

– Bridget Meijer, Manager New Markets SurePay

How VoP can benefit your Bank

Fraud & Repairs

- Protect your customers against fraud and misdirected payments

- Remove friction in the international payment process

- Avoid payment investigations

- Avoid rejected instructions

Domestic & Cross-Border solution

- One connection via SurePay

- SurePay connects to European countries/schemes with a Verification of Payee solution

- SurePay makes sure the request is translated in the correct format

Clean Payment Order

- Trust from customers

- Contributes to a positive reputation

- Fast and efficient cross border payment process

- Lower operational costs