Understanding the EU Instant Payments Regulation (IPR): What banks need to know

The EU Instant Payments Regulation (IPR) is set to transform the European payments landscape by making instant payments a mandatory standard for all financial institutions by 2025. This regulation mandates that payment services must be available 24/7, processed in real time, and as affordable, secure, and accessible as traditional credit transfers. For banks and payment service providers (PSPs), the IPR brings both opportunities and challenges as they must comply with these new standards while enhancing their existing infrastructure.

One of the key compliance components is the implementation of Verification Of Payee (VOP), a critical tool for fraud prevention and ensuring transaction accuracy. As the deadline approaches, it’s essential that banks begin preparing now. In this blog, we’ll discuss the key requirements of the IPR, its benefits for both banks and consumers, the challenges involved, and how SurePay can help banks seamlessly navigate this regulatory shift.

What is the EU Instant Payments Regulation?

The EU Instant Payments Regulation (IPR) is a groundbreaking legislative initiative aimed at making instant payments the new standard across Europe. By requiring instant payment options to be as affordable, secure, and accessible as regular credit transfers, the regulation seeks to modernise payment infrastructures and boost financial inclusivity.

For banks, this means adapting to new operational standards while addressing customer expectations for seamless, secure payments.

What Are Instant Payments?

Instant Payments are electronic payments that are processed and settled almost immediately, 24/7, 365 days a year. Unlike traditional bank transfers, which can take hours or even days to complete, Instant Payments ensure that funds are available to the recipient within seconds.

Key features of Instant Payments include:

- Speed: Transactions are processed in real-time.

- Availability: Payments can be made and received any time, including weekends and holidays.

- Certainty:Once the payment is processed, it cannot be reversed, offering finality.

- Coverage: Instant Payments are currently offered within the SEPA region and are increasingly adopted worldwide.

Watch our Instant Payments expert Eelco Rietveld explaining the Instant Payments Regulation.

Why IPR Matters for Banks and PSPs

IPR is mandatory for all EU-based payment service providers (PSPs). Compliance not only avoids legal penalties but also ensures your institution remains competitive in an evolving financial ecosystem. A key feature of IPR is Verification Of Payee (VOP), a crucial tool for preventing fraud and payment errors by verifying payee details before completing transactions.

Instant Payments Regulation timeline

Key Milestones

The European Commission has outlined clear deadlines for IPR compliance:

- March 2024: Initial deadlines for integrating basic compliance measures.

- 2025: Full compliance required for all regulated entities, including VOP implementation.

Why Start Early?

Delaying compliance efforts can lead to rushed implementations, increasing the risk of errors and operational disruptions. Early adoption ensures your systems are prepared, minimises liability, and positions your bank as a trusted financial partner.

What does the IPR require?

IPR compliance demands significant changes to payment processes.

Key requirements include:

- Coverage across channels: VOP requests must be available in all payment initiation channels at no extra cost to users.

- Support for multiple transaction types: Both Instant Credit Transfers and regular Credit Transfers require VOP verification.

- Batch payment capabilities: Banks must enable VOP checks for single and batch payments, with opt-in or opt-out options for the latter.

- Pre-authorization checks: Every transaction must undergo a VOP check before payment authorization.

- Responding to VOP requests: As a Payee PSP, banks must handle incoming VOP requests to avoid liability and protect customers.

These requirements demand robust technical infrastructure and significant process adjustments. Read more about the requirements in the VOP playbook by the EPC.

Benefits of the Instant Payments Regulation

The Instant Payments Regulation (IPR) brings significant advantages to both financial institutions and end-users, fundamentally improving the speed, security, and accessibility of payment systems across the EU.

For banks and payment service providers

The IPR drives innovation and operational benefits for financial institutions, including:

- Fraud reduction and liability minimisation: Verification Of Payee reduces the risk of misdirected payments and associated fraud, saving costs and protecting trust.

- Streamlined domestic and cross-border transactions: Standardisation across SEPA simplifies compliance and operational processes, reducing complexity and cost.

- Opportunities for competitive differentiation: Early compliance allows banks to position themselves as leaders in Instant Payments, attracting new clients and bolstering customer loyalty.

- Cost efficiency through modernisation: Upgraded infrastructure results in long-term savings and the ability to offer innovative payment solutions.

For consumers and businesses

The IPR benefits end-users in numerous ways:

- Real-time transactions: Payments are processed within seconds, 24/7, eliminating delays caused by weekends or banking hours.

- Enhanced cash flow for businesses: SMEs and other enterprises benefit from faster access to funds, improving their operational agility.

- Improved fraud prevention: Mechanisms like VOP ensure payments reach the correct recipient, fostering trust in the payment system.

- Greater financial inclusion: Accessible and affordable payment services become available to a broader audience, empowering individuals and businesses of all sizes.

Common challenges banks face with IPR compliance

Legacy systems and infrastructure

Many banks rely on outdated systems that were not designed for the speed and complexity of real-time payments. Upgrading these systems to handle 24/7 operation and high transaction volumes is both costly and time-intensive.

Pressure on IT systems

Real-time payment processing places constant demands on IT infrastructure, requiring systems to function seamlessly under heavy loads. This creates challenges for IT teams already managing other priorities.

Data privacy and security

With real-time payments, banks must ensure customer data is handled securely and complies with strict GDPR regulations. Meeting these requirements involves significant investments in technology and processes to prevent data breaches and ensure compliance.

Cost perception

Compliance can be seen as expensive, especially for smaller banks. Beyond the initial investment in technology, there are ongoing costs for system maintenance, upgrades, and additional staff.

Build vs. buy dilemma

Banks face the critical decision of building an in-house VOP solution or purchasing one from a third-party provider. Building in-house offers control but demands significant resources, while third-party solutions require finding a provider that fits the bank’s needs and integrates seamlessly with existing systems.

How to choose the right IPR solution provider

Regulatory compliance

Ensure the provider fully adheres to the European Payments Council (EPC) Rulebook and offers a solution designed to meet its requirements for Instant Payments.

Scalability and reliability

Select a provider whose solution can handle growing transaction volumes without performance issues. A scalable system ensures your investment remains viable as your needs expand.

Seamless integration

Look for a solution that integrates easily with your existing systems and supports multiple payment schemes, like SEPA and SWIFT. This minimises disruptions and enhances operational efficiency.

High-accuracy verification

The right solution should provide detailed insights into mismatches, distinguishing minor errors like typos from significant issues. This helps reduce unnecessary rejections and improves the user experience.

Proven experience

Choose a provider with a strong track record of successful implementations, particularly with large-scale banks. Their experience can be invaluable in navigating challenges and ensuring smooth implementation.

Next steps for banks: Preparing for 2025

The 2025 compliance deadline for the Instant Payments Regulation (IPR) is fast approaching, leaving banks with little time to act. Preparing now will prevent last-minute issues and ensure a smooth transition to compliance. Here are some actionable steps banks can take:

- Conduct a gap analysis Assess your current payment systems to identify areas that do not meet IPR requirements. Evaluate your ability to handle instant payments, manage Verification Of Payee requests, and respond to customer demands for real-time transactions.

- Upgrade systems and infrastructure Invest in modernising your technology to meet the demands of real-time payment processing. Ensure your systems can handle 24/7 operation and accommodate both Instant Credit Transfers and batch payments.

- Select the right VOP solution provider Partner with a trusted provider who offers a scalable, compliant, and easily integrated VOP solution. This decision will significantly impact your compliance journey, so choose a vendor with proven experience in the banking sector.

- Train your teams Equip your staff with the knowledge and skills needed to implement and operate your upgraded systems. Comprehensive training will empower teams to handle compliance with confidence and efficiency.

- Communicate with stakeholders Keep customers informed about the changes and benefits brought by the Instant Payments Regulation. Transparency builds trust and encourages adoption of new payment channels.

By taking these steps early, banks can reduce the risk of non-compliance, mitigate implementation challenges, and position themselves as leaders in the evolving payments landscape.

FAQs on the Instant Payments Regulation

What is the difference between Instant Payments and regular credit transfers?

Instant Payments transfer funds within seconds, 24/7, ensuring immediate availability to the payee. Regular credit transfers, by contrast, can take up to one business day and are subject to limited banking hours and delays during weekends or holidays.

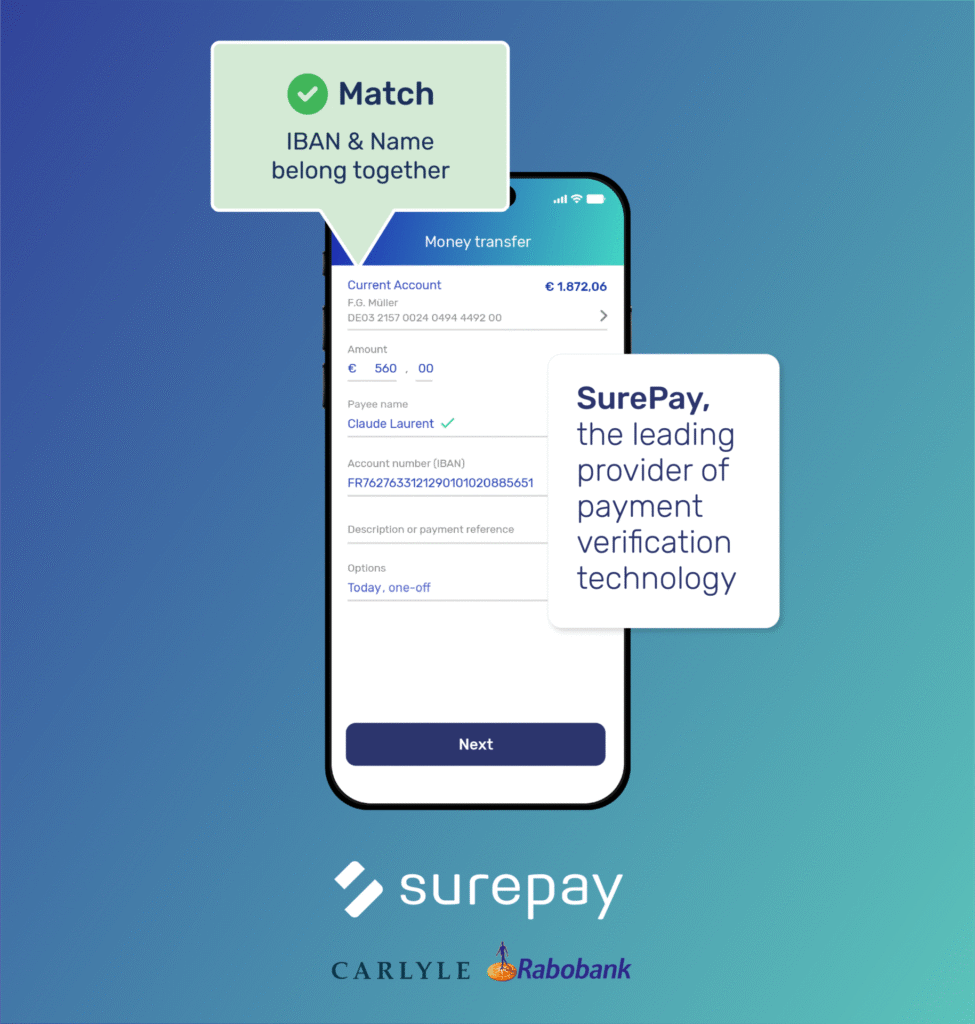

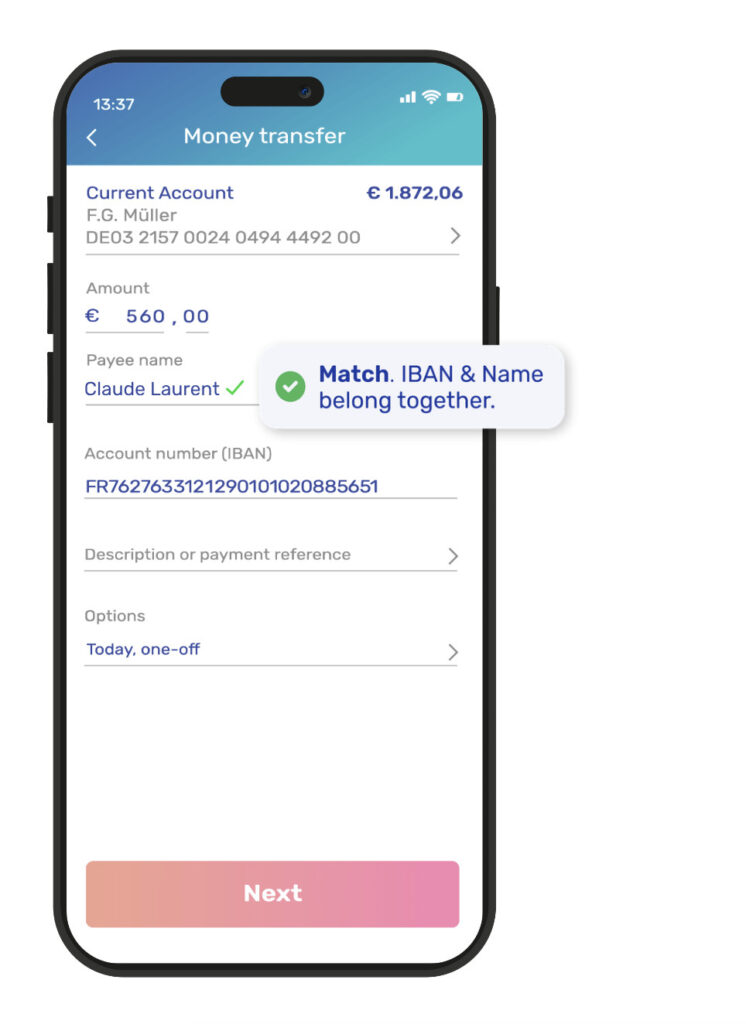

How does Verification Of Payee work?

Verification Of Payee (VOP) checks that the payee’s name matches the account number before authorising a payment. If details don’t match, the bank notifies the payer, explaining the issue and preventing misdirected or fraudulent payments.

What are the penalties for non-compliance?

Non-compliance may result in financial penalties, reputational damage, and exclusion from the real-time payments ecosystem. Banks risk losing customer trust and competitiveness, making compliance essential to their future success.

Want to know more about Verification Of Payee?

Best in class Verification Of Payee solution

With our European Verification Of Payee solution, the combination of IBAN & Name will be checked in EU countries, the UK and the world.

Download our whitepaper

Find your answers in our latest whitepaper: “Connecting Europe through Verification Of Payee”