Verification Of Payee in the EU: What it is, how it works, and how to prepare

With the 2025 deadline for Verification Of Payee (VOP) compliance fast approaching, European banks must act now to ensure they’re prepared for this crucial regulatory shift. VOP is not just a nice-to-have security feature—it’s becoming a mandatory requirement for all EU banks, driven by the rise of Instant Payments and the need to protect against fraud and errors in real-time transactions.

This blog will guide you through what VOP and Instant Payments are, how they work, and why they’re vital for your bank’s security and compliance efforts. We’ll also discuss what to look for in a VOP solution, how to prepare for the upcoming 2025 deadline, and what actions you should take to stay ahead of the curve. Let’s dive in.

What is Verification Of Payee (VOP)?

Verification Of Payee (VOP) is a critical security and compliance measure used in banking to ensure that money is sent to the intended recipient.

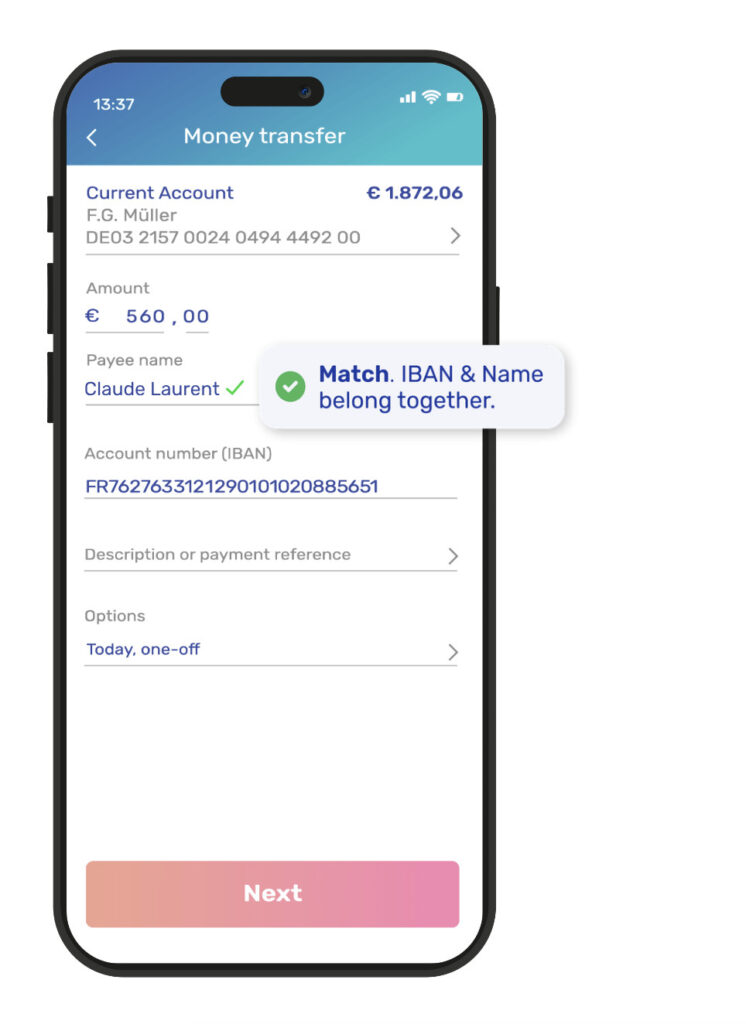

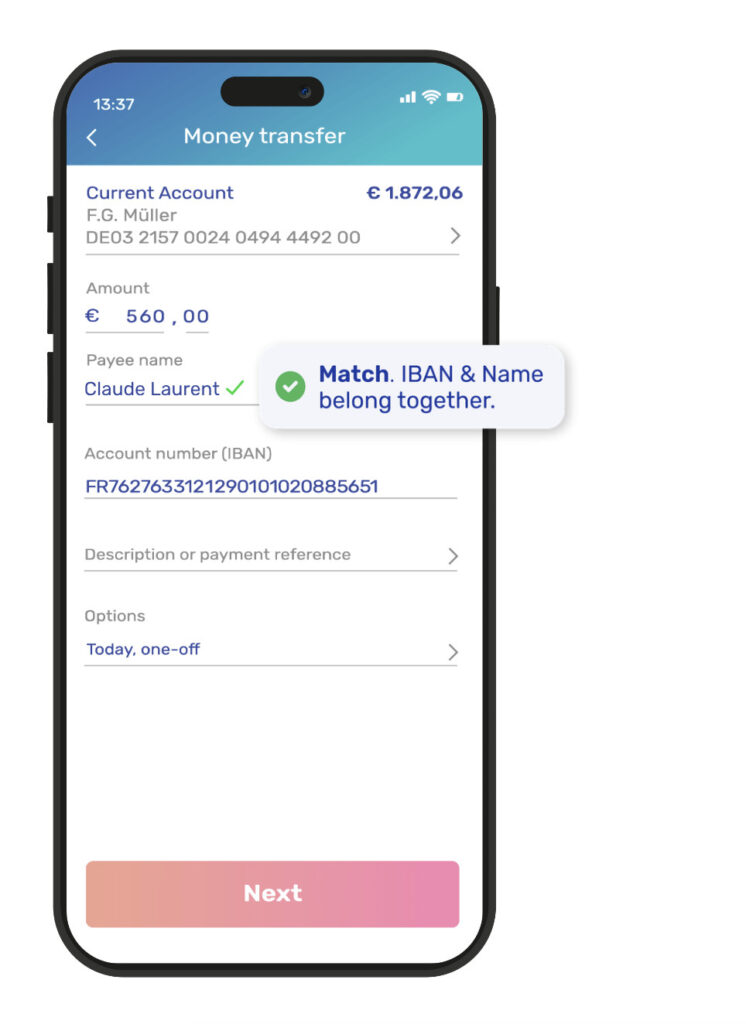

It works by matching the name provided by the payer during a transaction with the name registered to the recipient’s bank account. If there’s a mismatch, the system alerts the user, reducing the risk of fraud and human error in payment processes.

VOP & Instant Payments

Verification Of Payee is particularly relevant in the context of Instant Payments, a system that allows funds to be transferred in real-time, 24/7. Instant Payments are changing the way transactions occur across Europe, because they provide unparalleled speed and convenience for consumers and businesses alike.

However, their immediacy also heightens the risk of fraud and errors—once the money is sent, it’s often irretrievable. By integrating VOP with Instant Payments, banks can ensure accuracy in real-time and safeguard against fraud.

Read more about the relationship between VOP and Instant Payments in this blog.

Want to know more? Also read our blog ‘New EU Law: Mandatory Payee Verification for All Instant Payments and SEPA Transactions’.

Why Verification Of Payee is essential for EU banks

Verification Of Payee (VOP) is no longer just a nice-to-have for European banks—it’s becoming a regulatory necessity. With the European Payments Council (EPC) publishing the final VOP Rulebook in October, compliance is now a pressing priority for all banks in the EU.

Here’s why VOP is critical for the financial sector, how it aligns with broader market trends, and the impact it has on banks:

Compliance with the Instant Payments Legislation

The Instant Payments Legislation mandates that all EU banks must adopt measures to ensure secure, real-time payments. Verification Of Payee is central to this initiative, as it helps prevent fraud and payment errors before transactions are completed.

The VOP Rulebook outlines exactly what a compliant solution must look like, including response times, response types, and interoperability with systems like the EPC Directory Service.

Preventing fraud and strengthening trust

With the rise of Instant Payments, attention has shifted to safeguarding against fraud and errors. VOP serves as a vital tool for preventing scenarios where funds are accidentally or fraudulently sent to the wrong recipient.

By verifying payee details—such as ensuring an IBAN matches the recipient’s name—banks can:

- Block unauthorized push payment (APP) fraud.

- Avoid costly and time-consuming mistakes caused by incorrect account information.

- Foster confidence among consumers in the security and reliability of their bank.

How does Verification Of Payee work?

- The Recipient’s Name: Who they believe they’re paying.

- The Bank Account Details: The IBAN or account number of the recipient.

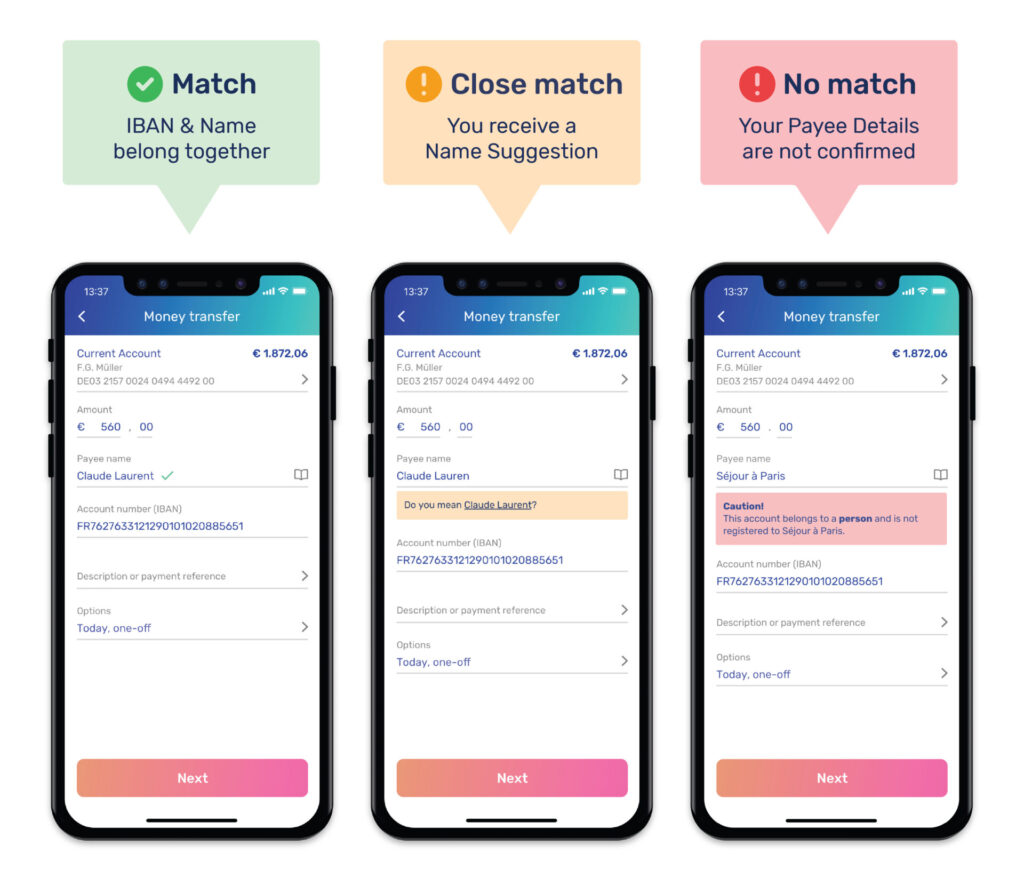

The VOP system cross-checks this information against the data held by the recipient’s bank. The outcome is one of the following:

- Match: The name matches the bank account details, and the payment proceeds.

- No Match: The name and account details don’t align, and the payer is informed.

- Close Match: There’s a slight discrepancy (e.g., typos, format issues), and the payer is advised to double-check.

Verification Of Payee vs. Confirmation of Payee: What's the difference?

While often used interchangeably, VOP and Confirmation of Payee (CoP) differ slightly:

- Verification Of Payee (VOP): Primarily used in the EU, covering both SEPA and SWIFT payment systems, with broader applications across international transactions.

- Confirmation of Payee (CoP): A UK-specific system introduced by UK banks to reduce payment fraud in domestic transactions.

Both aim to achieve the same goal—secure and accurate payments—but they operate within different regulatory frameworks and geographies.

Which banks use Verification Of Payee?

VOP is rapidly becoming the standard for European banks, driven by compliance requirements for Instant Payments and increasing demands by consumers for secure, error-free transactions.

Many leading financial institutions already rely on VOP to enhance security, improve customer trust, and streamline payment processes. In the Netherlands, for example, 99.9% of all bank accounts are already covered by VOP-provider SurePay.

Common questions about Verification Of Payee

Who owns the Verification Of Payee?

The Verification Of Payee (VOP) system is overseen by the European Payments Council (EPC). It is part of the EU’s regulatory framework for payments and is designed to ensure that banks in SEPA countries comply with the new Instant Payments legislation. VOP is part of broader efforts to reduce payment fraud and enhance security across the European payments landscape.

Who owns the Confirmation Of Payee?

The Confirmation of Payee (CoP) scheme is owned and governed by Pay.UK, the UK’s payment systems regulator. It applies to banks and payment service providers within the UK. While CoP is similar in function to Verification Of Payee (VOP), which is used across Europe, each scheme operates under its respective regulatory framework.

Is VOP mandatory for all EU banks?

Yes, VOP will be mandatory for all EU banks starting in 2025. This is part of the EU’s efforts to enhance security and reduce fraud in the payments ecosystem, especially with the rise of Instant Payments. Banks must implement VOP solutions to comply with the EPC’s Verification Of Payee Rulebook to ensure that payments are accurate, secure, and compliant.

How do I comply?

To comply with VOP regulations, banks need to implement a system that verifies the payee’s details before the payment is processed. This means selecting a reliable VOP vendor who meets the requirements outlined in the EPC Rulebook. The right provider will offer integration with your existing payment systems, ensure real-time verification, and support compliance with both domestic and cross-border payments.

Preparing for 2025: What to do now

As the 2025 deadline for mandatory Verification Of Payee (VOP) compliance approaches, it’s essential for EU banks to start preparing. VOP will be a key component of the Instant Payments infrastructure, and banks must ensure their systems are equipped to meet the regulatory requirements.

How to meet the Verification Of Payee requirements

Banks must adhere to several specific requirements to ensure compliance with the EPC’s VOP Rulebook. Here’s a summary of the key obligations:

- Coverage across channels: VOP requests must be offered in all payment initiation channels at no additional cost to users.

- Transaction types: Both Instant Credit Transfers and regular Credit Transfers require VOP verification.

- Batch payments: VOP checks must be available for single and batch payments, with opt-in or opt-out options for the latter.

- Pre-authorization checks: Every transaction must undergo a VOP check before payment authorization.

- Responding as a Payee PSP: Banks must handle incoming VOP requests to prevent liability and protect their customers.

Understanding these requirements is the first step toward compliance, but meeting them effectively demands careful consideration of your approach and solution provider.

What to look out for in a Verification Of Payee solution

-

Compliance with the EPC Rulebook

Ensure that the VOP solution aligns with the latest requirements outlined in the European Payments Council (EPC) Rulebook. The solution should meet all necessary compliance standards for Instant Payments and provide secure, accurate Verification Of Payee details in real time.

-

Scalability and flexibility

The right VOP solution should scale with your needs as payment volumes grow. Look for a provider that can handle high-volume transactions and support both domestic and cross-border payments seamlessly.

-

Integration capabilities

A seamless integration with your existing payment infrastructure is crucial. The solution should be easily integrated with your core banking systems and work with multiple payment schemes (SEPA, SWIFT, etc.) without disrupting operations.

-

Accuracy in matching

The VOP solution must deliver high accuracy in (mis-)matching the payee’s details. Some VOP solutions simply return a “no match” result, while others provide more detailed insights. For instance, if the payee’s name doesn’t match, a more advanced solution will clarify whether it’s due to a typo, an account type mismatch, or another issue. It’s important to choose a solution that can give a clear explanation of why a mismatch occurred.

-

Track record and experience

Experience matters when it comes to VOP. Look for a vendor with a proven track record of successful implementations, especially with large-scale banks across multiple countries. A provider with years of experience will be better equipped to guide you through the implementation and address any challenges.

Want to know more?

Best in class Verification Of Payee solution

Download our whitepaper

Find your answers in our latest whitepaper: “Connecting Europe through Verification Of Payee”