The hidden risks in batch payments: Why EU banks need Verification Of Payee

Imagine a multinational corporation processing payroll for thousands of employees. A single spreadsheet contains all the payment details, and the bank processes the batch in one go. But buried in that list, one IBAN is incorrect. The salary never reaches the employee. The company’s finance team scrambles to fix the error, and the bank is left handling frustrated calls.

The silent vulnerability in every batch payment

Batch payments are a pillar of business banking, used for everything from payroll to supplier payments. But while they offer efficiency, they also introduce significant risks. A single misdirected payment can lead to financial loss, regulatory issues, and reputational damage.

With instant payments becoming the norm across Europe, errors can no longer be corrected after the fact. Banks must catch issues before payments are processed. This is where **Verification Of Payee (VOP)** becomes crucial.

What makes batch payments so risky?

Unlike single transactions, batch payments bundle thousands of payments into one submission. This scale introduces three major risks:

1. Manual data entry errors

Many batch files are manually compiled in spreadsheets, increasing the risk of typos or formatting mistakes. Even a single incorrect digit in an IBAN can redirect funds to the wrong account.

2. Fraudulent account manipulation

Fraudsters exploit bulk payments by inserting unauthorised or manipulated IBANs into batch files, hoping they go unnoticed. Without verification, these fraudulent payments may only be detected after funds have been lost.

3. Compliance pressures in the era of Instant Payments

The EU Instant Payments Regulation (IPR) is pushing banks toward real-time payment processing. However, with instant transactions, mistakes and fraud cannot be reversed easily. Banks need a real-time verification mechanism to ensure accuracy and security before payments are executed.

How Verification Of Payee secures batch payments

SurePay’s Verification Of Payee offers a proactive solution, ensuring payments reach the intended recipient before funds are transferred. Here’s how it works:

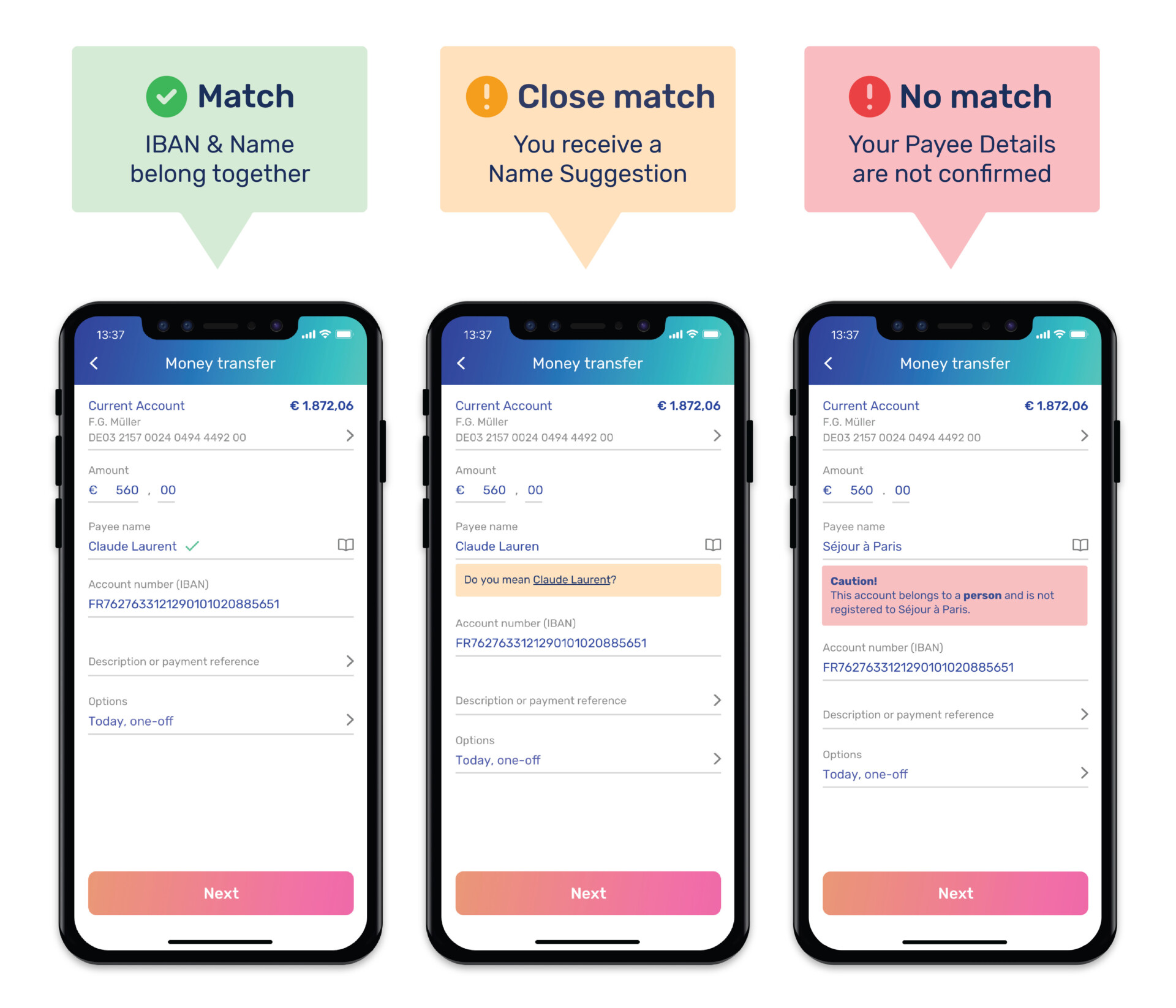

1. IBAN and payee name matching

Before processing, SurePay’s system verifies that the provided IBAN belongs to the intended recipient, reducing errors and fraud risks.

2. More sophisticated ‘no match’ Handling

Unlike basic verification tools that simply reject mismatches, SurePay provides detailed insights on why a mismatch occurred—helping banks and businesses make informed decisions.

3. Scalable for high-volume transactions

Designed to handle large-scale batch processing, SurePay’s system seamlessly integrates into existing banking infrastructure without disrupting workflows.

4. Trusted across Europe

With over 200 banks already using SurePay, including major institutions across the Netherlands, the UK, and Europe, it’s the most trusted and proven VOP solution available.

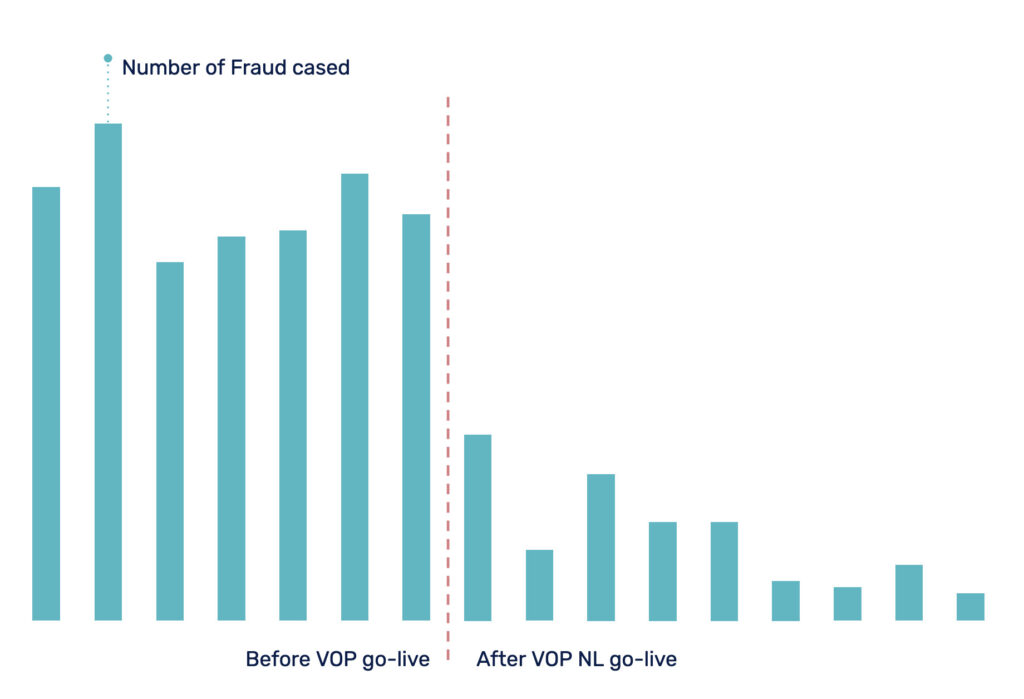

Case Study: Reducing payment errors in a major European bank

A leading European bank was struggling with high volumes of misdirected payments due to incorrect IBANs in payroll and supplier transactions.

By integrating SurePay’s Verification Of Payee, the bank:

- Reduced payment errors by 80%, minimising costly manual interventions

- Enhanced fraud prevention, blocking unauthorised payments before processing

- Improved customer experience, ensuring funds reached the correct recipients on time

The future of batch payments: Accuracy, security, and compliance

With instant payments becoming the new standard, EU banks cannot afford to rely on outdated verification methods. Ensuring accuracy and security before execution is no longer a luxury—it’s a necessity.

Why now is the time to act

- The EU Instant Payments Regulation will require stronger verification processes.

- Fraud tactics are evolving, making proactive detection essential.

- Businesses demand greater payment accuracy to protect cash flow.

By implementing Verification Of Payee, banks can move from reactive error handling to proactive payment accuracy, strengthening security, trust, and compliance.

Ensure your bank is ready for the future of payments

Batch payments don’t have to be a weak spot. Find out how SurePay’s Verification Of Payee can safeguard your transactions.

Schedule a demo today to learn how your bank can improve accuracy, reduce fraud, and stay ahead of regulatory changes.

Want to know more about Verification Of Payee?

Best in class Verification Of Payee solution

With our European Verification Of Payee solution, the combination of IBAN & Name will be checked in EU countries, the UK and the world.

Download our whitepaper

Find your answers in our latest whitepaper: “Connecting Europe through Verification Of Payee”