Verification Of Payee (VOP) Rulebook by the EPC: What it says and how SurePay complies

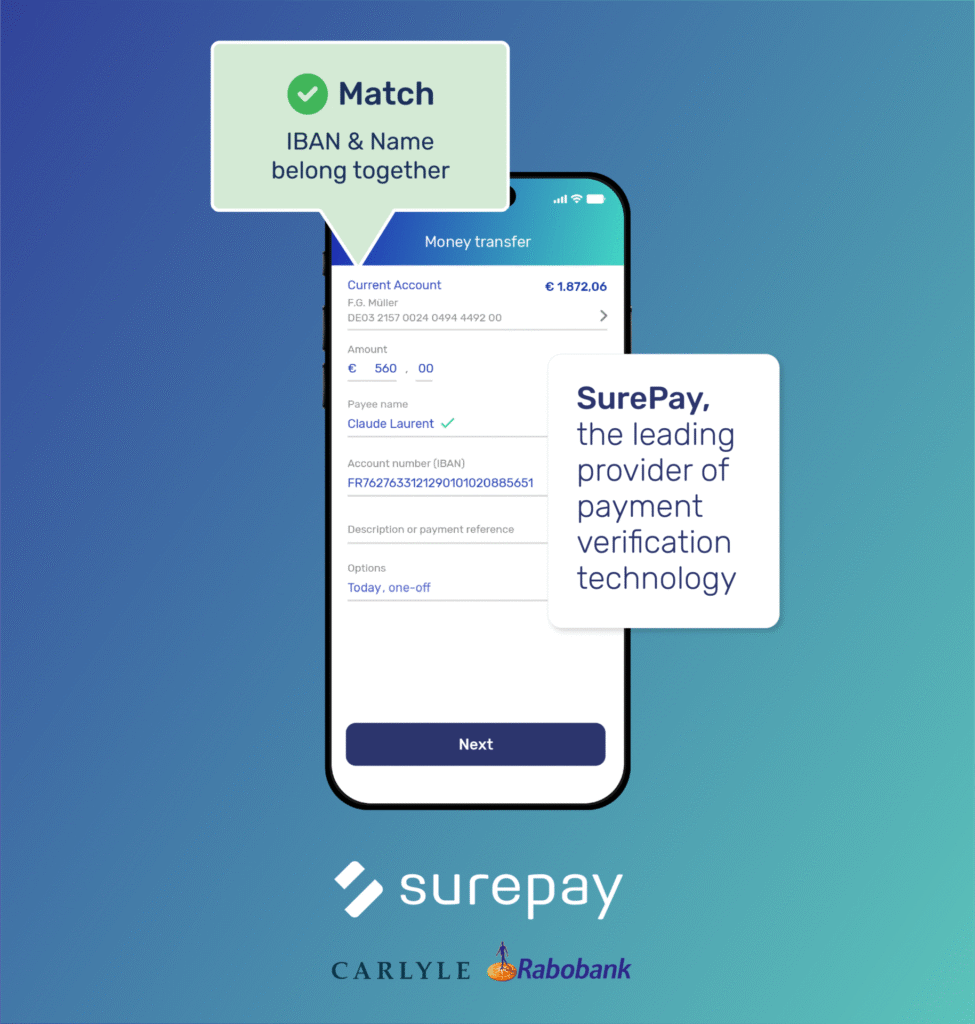

The final version of the VOP Rulebook by the European Payments Council (ECP) was published 10 October. It sets essential standards for Verification Of Payee (VOP) processes. As the largest VOP vendor, SurePay has been at the forefront of these developments, and we’re already fully compliant. Here’s what the Rulebook outlines—and how we meet or exceed each requirement.

First: We see two major changes in comparison to the initial version for public consultation:

- The maximum execution time is extended from 3 to 5 seconds (preferably still within 1 second)

- The requesting PSP can only request matching against a combination of:

- IBAN and a Name or

- IBAN and Identification Code (only in case of checking a legal person)

Of course there’s more, read below:

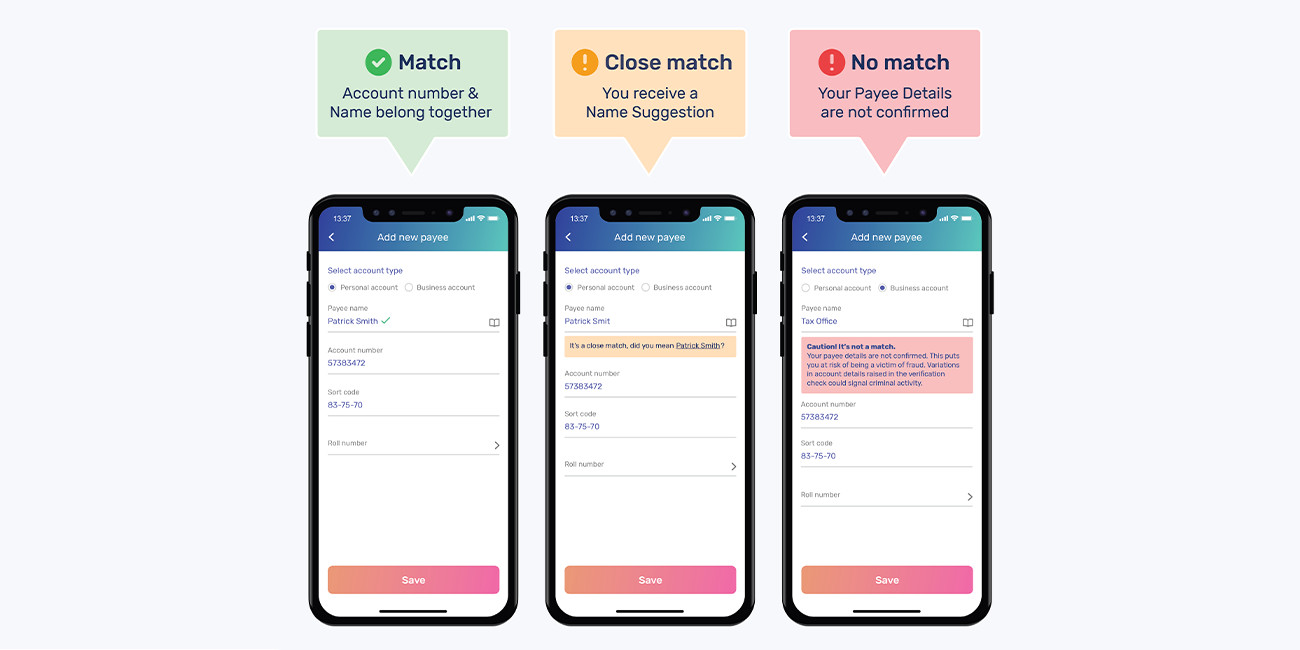

Response types

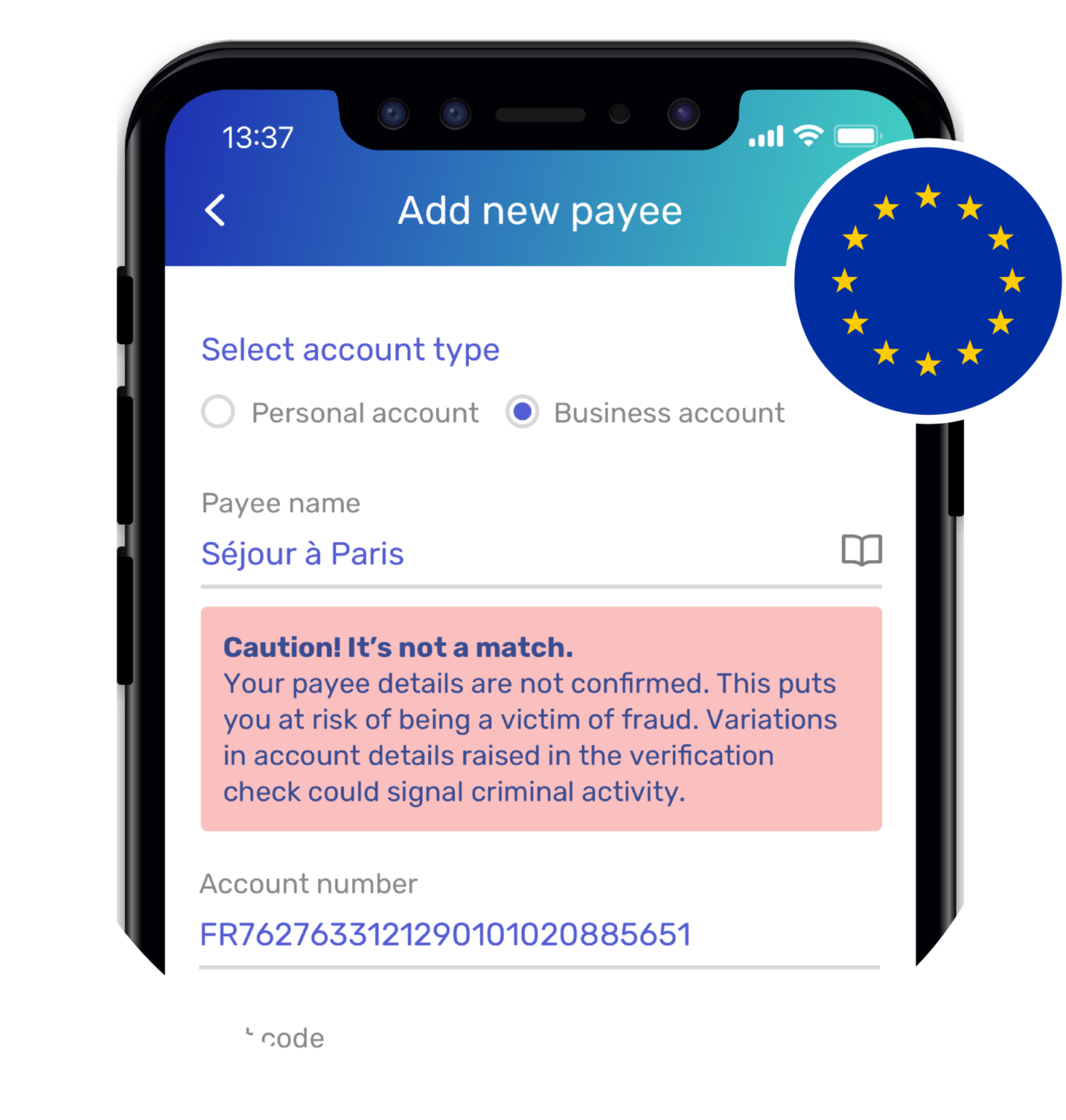

The Rulebook mandates providing a warning in case of a Close Match, No Match or when a matching response cannot be provided. SurePay’s algorithm efficiently delivers these results, ensuring accuracy and clarity in real-time.

Irrespective of the VOP check outcome, the payer/requester can decide to continue with the payment

Response time

Speed is key! The Rulebook demands a response within 5 seconds, preferably within 1 second. With SurePay, we consistently deliver lightning-fast results within this timeframe, keeping your transactions secure and seamless.

Bulk payments

The Rulebook prescribes how to perform single checks, but gives the possibility to PSPs and PSU’s to exchange multiple VOP requests as a bulk request. SurePay’s Bulk API will support large-scale checks, processing multiple payments in a single API call—ideal for businesses handling high payment volumes. Today customers can already check files in our Online Portal.

IBAN - Identification Code

IBAN and name are required in the request when checking against natural persons

IBAN and Identification code (like LEI) can be used when checking legal entities / organisations. Our solution already supports various identifiers, ensuring flexibility and accuracy when verifying payments.

Interoperability with EPC Directory Service

Drawing on our experience in the UK market, where VOP has been a cornerstone of payment security, we ensure seamless interoperability with other participants.

At SurePay, we are proud to be fully aligned with the ECP’s VOP Rulebook. With our upcoming tweaks SurePay is ready to offer the most robust and compliant VOP solution available.

Take the Next Step with SurePay

Ready to elevate your payment processes and ensure compliance with the latest VOP regulations? SurePay is here to help. Our advanced Verification Of Payee solution is designed to seamlessly integrate with your existing systems, providing you with the tools you need to protect your customers and enhance their trust. Contact SurePay today to learn how we can support your transition to Instant Payments and secure your position as a leader in the financial industry.

Want to know more?

Best in class Verification Of Payee solution

Schedule a meeting today

We are here to help answer any questions you may have about Verification Of Payee and the Instant Payments regulation.