Enhance efficiency and accuracy across various responsibilities for treasurers through the implementation of Verification Of Payee

In the complex landscape of financial management, treasurers play a pivotal role in steering organisations toward financial success. The multifaceted responsibilities of a treasurer span from cash flow monitoring to strategic financial planning. In this blog, we explain how Verification Of Payee enhances efficiency and accuracy in several treasurer’s duties.

1. Compliance

Treasurers ensure strict compliance with banking regulations and internal policies governing financial transactions and accounts. Adherence to compliance standards is imperative for maintaining the organisation’s financial integrity.

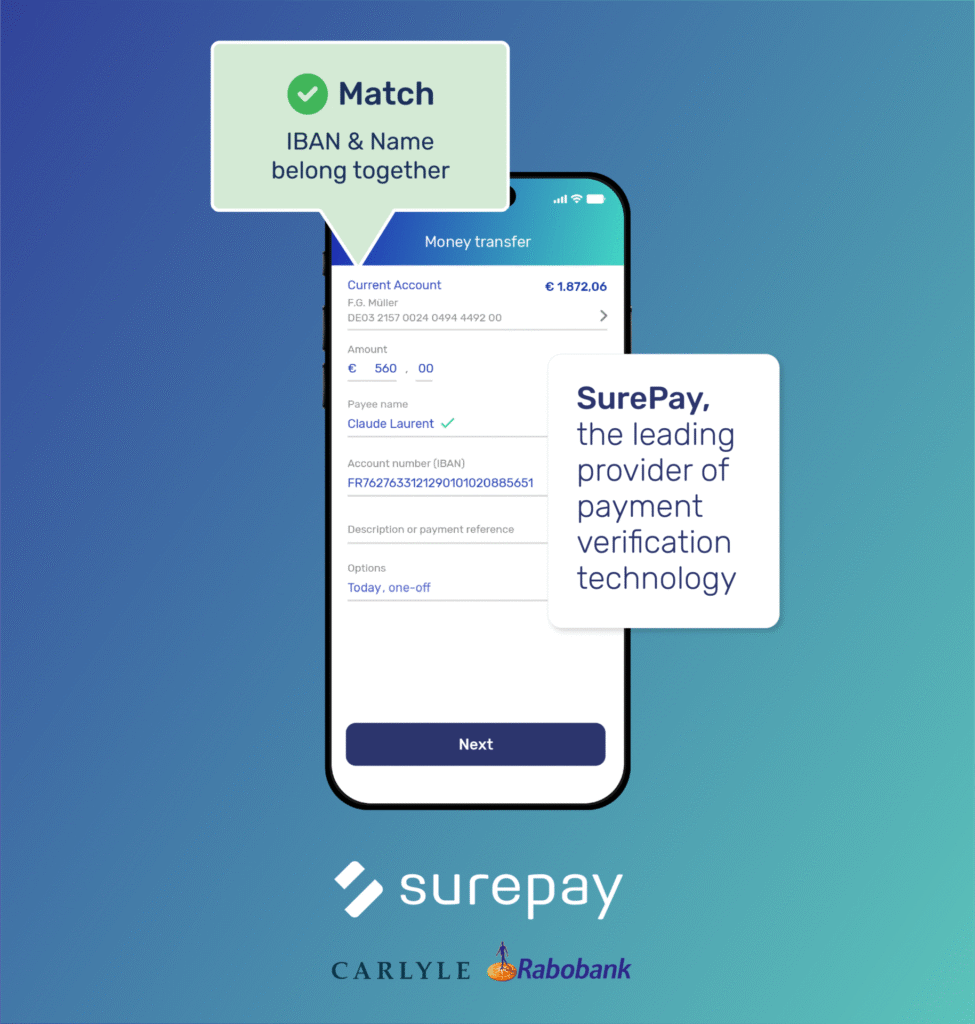

Verification Of Payee checks if the beneficiary’s name and IBAN match. Next to that, it examines the number of account holders associated with an IBAN and checks the details of other account holders if necessary.

This solution supports your burden of proof for both internal and external audits when it comes to strict compliances.

2. Financial Reporting

Treasurers prepare accurate and timely financial reports, ensuring transparency and compliance with regulatory requirements and accounting standards. Clear reporting aids stakeholders in making informed decisions.

Verification Of Payee can be an important part of your financial report. You visibly contribute to preventing fraud and incorrect payments, which enhances the transparency and compliance with regulatory requirements and accounting standards.

3. Risk Assessment

Treasurers evaluate investment risks and diversify strategies to preserve capital and achieve financial objectives. Mitigating risks is essential in maintaining financial health and safeguarding the organisation against market fluctuations.

To mitigate the risk of paying to or collecting from the wrong person, you can use the Verification Of Payee. In case of an IBAN and Name not matching, you get a warning that there may be fraud.

Next to this, you ensure the correct customer data in your administration, as you will be notified if there are changes in the recipient/payer details.

This (in)directly prevents fraud, unnecessary costs, complaints and even reputational damage.

4. Insurance

Managing insurance policies is a risk mitigation strategy. Treasurers assess risks and ensure appropriate coverage to protect the organisation from financial losses due to unforeseen events or liabilities.

With Verification Of Payee, you protect yourself and your organisation from financial losses due to fraud or incorrect payments. The solution adds an extra layer of accuracy to financial transactions.

Conclusion

As stewards of an organisation’s financial health, treasurers shoulder a diverse array of responsibilities. From strategic financial planning to day-to-day cash flow management, their role is integral to the success and stability of the organisation. With Verification Of Payee at their disposal, treasurers can navigate the financial landscape with increased confidence, ensuring accuracy and efficiency in their vital duties. This solution not only streamlines processes but also aligns with the broader goal of enhancing the overall financial resilience of the organisation.