Swift Beneficiary Account Verification

One connection, global reach

Expand your reach on a global scale by leveraging the pre-validation service offered by Swift. SurePay is an official Enabler partner of Swift and can take banks from local Verification/Confirmation Of Payee/IBAN-Name Check to EU and beyond to Global.

Trust in a secure and accredited platform for a frictionless and fraud-resistant financial experience.

Explore the Efficiency of Swift Pre Validation

Discover the groundbreaking solution of Swift Pre Validation, designed to minimise errors and enhance the accuracy of payment messages prior to transmission. This approach empowers you to proactively validate payments, eliminating friction, minimising delays, and ensuring a smooth payment experience for your customers.

Traditional payment investigations can be both time-consuming and costly, resulting in frustrated customers. Imagine a scenario where you could prevent these investigations entirely. With Swift Pre Validation, you can verify the accuracy of payment data before initiating the transfer, guaranteeing that funds reach their destination seamlessly and maintaining the satisfaction of your customers. Say goodbye to payment hassles and welcome a new era of efficient, error-free transactions.

How does it work?

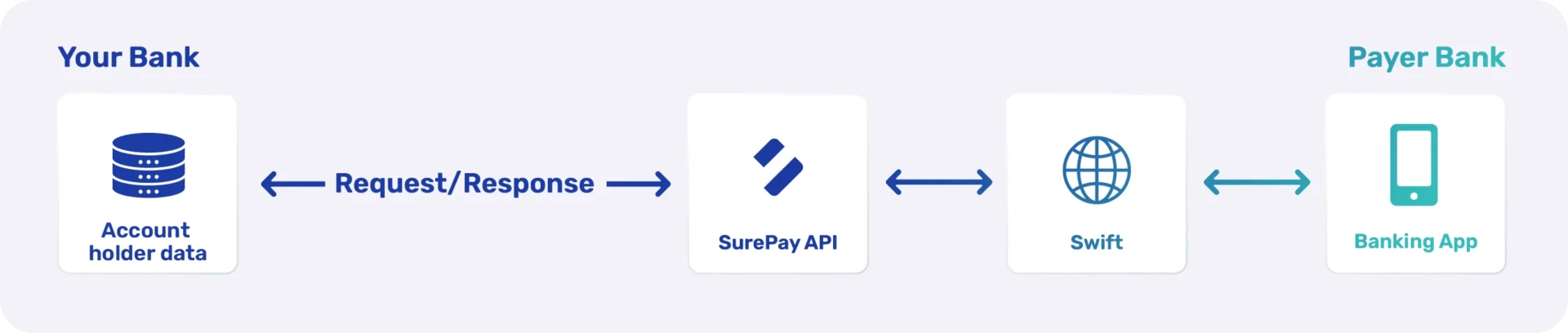

SurePay connects on behalf of the Bank to the Swift Beneficiary Account Verification (BAV) Service for sending a Verification Of Payee request (Consuming) and for responding to a Verification Of Payee request (Data provisioning).

Sending a Verification Of Payee Request (Consuming)

To do so, the Bank sends a request to SurePay, that includes:

- IBAN (Account Number)

- BIC Code

- User input (name)

On behalf of the Bank, SurePay will send the request to Swift based on the bank’s Swift certificate with the Pre Validation service selected. The Requests will be validated against the databases of the Participants through the use of the Swift BAV Scheme or against the central database from Swift named the ‘Central Beneficiary Account Verification’.

SurePay will send a Response back to the bank, containing a name matching result and – if necessary – additional information on the account.

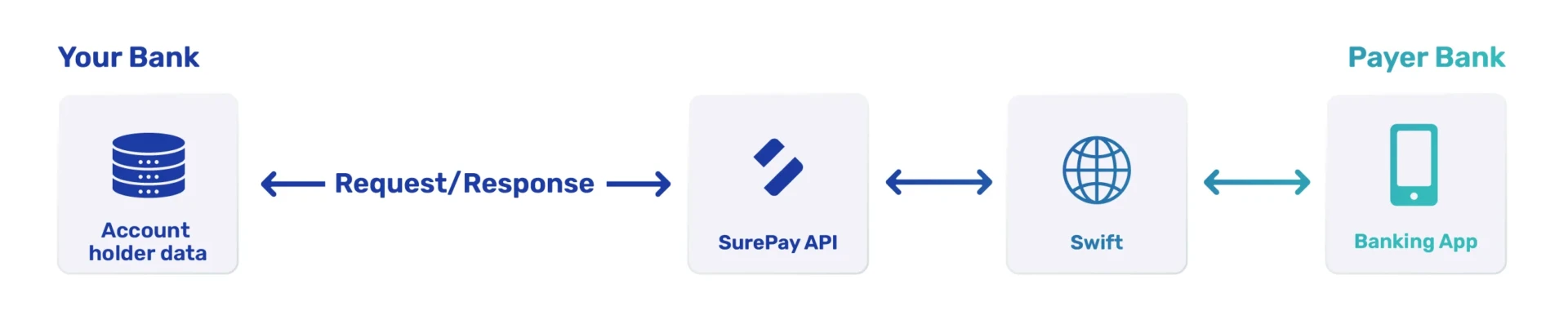

Responding to a Verification Of Payee Request (Data provisioning)

The Bank will respond to incoming requests via the Swift BAV Service where SurePay will match the incoming input against the data provided by the Bank and give back the response to the Swift BAV Service.

Other add-on features

for Banks & PSPs

European Batch Check

Read More →

Fraud Risk Indicator

Read More →

Switch Check

Read More →

PayID

With SurePay PayID customers can now easily and securely pay in your Banking App to friends and acquaintances on their contact list. In the future we will add more identification options to this service. SurePay PayID uses the smart Verification Of Payee algorithm for this.

Read More →

How can SurePay help?

Connect to the Pre Validation Service with SurePay

As a platform enabling partner of Swift SurePay can connect you as a bank to Swift Beneficiary Account Verification. This Benefits you as a bank with less IT impact and backlog issues and the re-use of the same Verification/Confirmation Of Payee/IBAN-Name Check connectivity. Interested in the benefits of Swift Beneficiary Account Verification for smoother payment processes? Contact Bridget Meijer, Manager of New Markets.