SurePay as fallback

VOP provider

Where SurePay can support

Strengthen your own VOP implementation by addressing common bottlenecks like Single Checks, Batch Verification or Routing. SurePay helps you move forward only where needed.

Why consider a fallback setup?

In the eurozone, VOP is already mandatory. Institutions must ensure continuous availability and DORA aligned resilience.

In non euro EU countries, the 2027 deadline still requires timely and robust implementation.

- stay compliant in a live environment

- mitigate operational and vendor risk

- safeguard your 2027 implementation timeline where applicable

Choose a trusted and proven platform

banks connected

Over

checks performed

Operating across

countries in complex regulatory and risk environments

Protecting over

organizations

Frequently asked questions

Even the best implementation plans face delays or unexpected issues. A fallback like SurePay ensures your institution remains compliant and protected—without losing valuable time or customer trust.

This is particularly relevant in the eurozone, where VOP is already mandatory and uptime is critical. It is equally relevant for non euro EU countries preparing for 2027.

SurePay can complement in-house or vendor solutions as a secondary route or fully integrated backup. We’re flexible in how we plug into your environment, minimising disruption.

SurePay implementations can be live in as little as 2 weeks, depending on your infrastructure and needs. This includes integration, testing and EPC compliance setup.

This is relevant both for urgent stabilisation in the eurozone and for timely implementation ahead of the 2027 deadline.

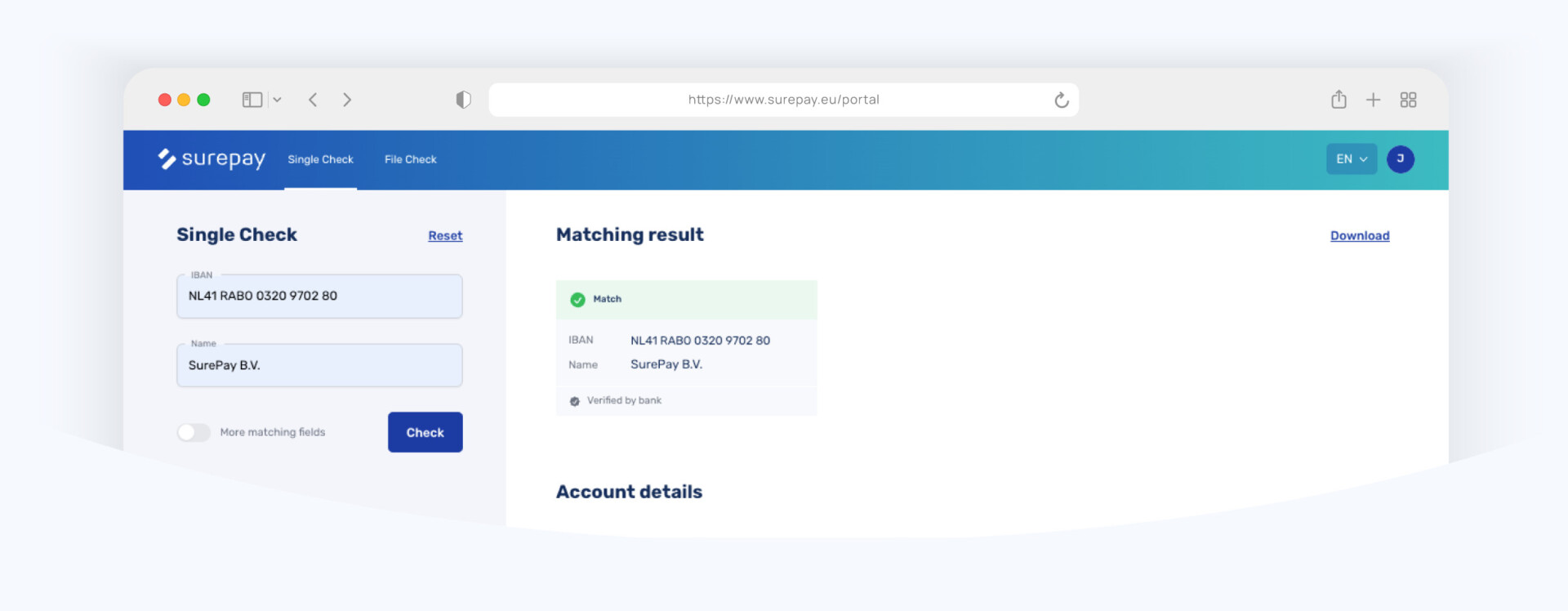

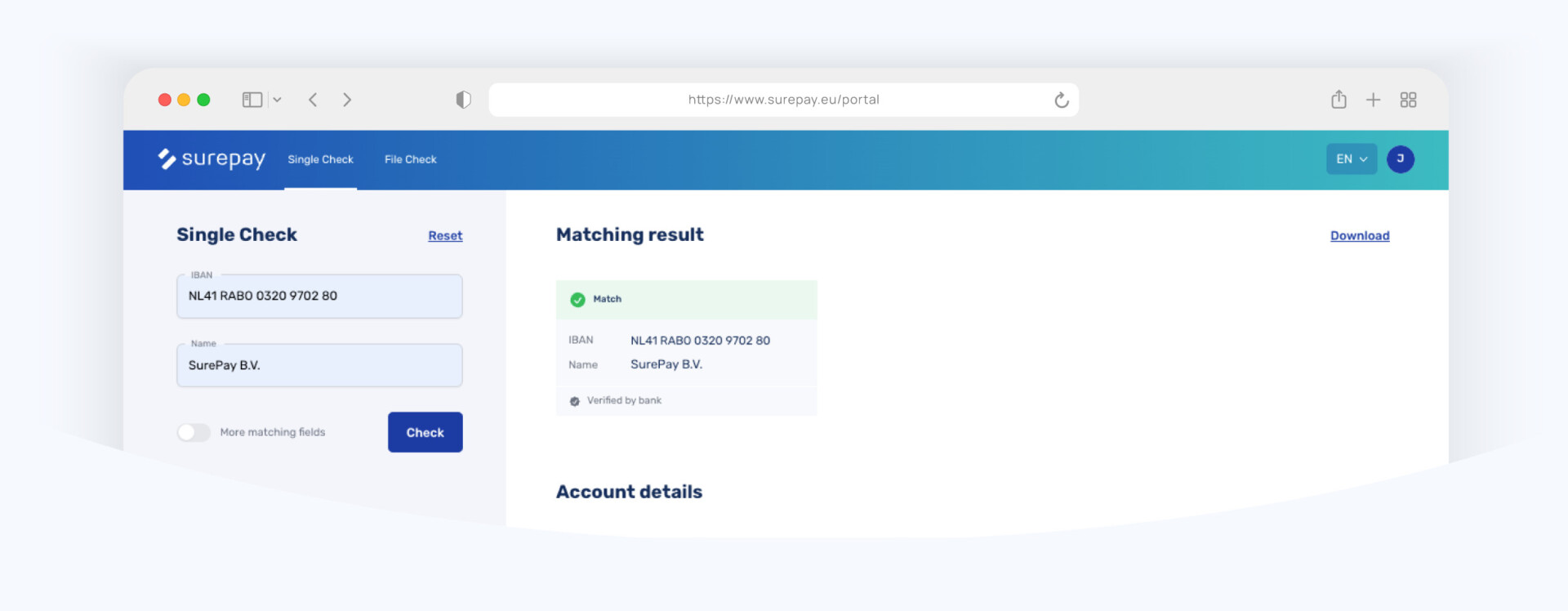

Yes. SurePay’s solution is fully VOP-compliant, integrated with the EDS (EPC Directory Service), and already supports batch and single VOP checks across domestic and cross-border payments.

A fallback runs in parallel or as a contingency. If your main solution falters, SurePay ensures continuity—without requiring a full transition. However, many of our fallback clients eventually scale SurePay into their primary solution due to its performance and reliability.

In the eurozone, fallback ensures continuity in a live regulatory environment. In non euro EU countries, it can safeguard timely compliance ahead of 2027.

We support institutions by safeguarding timelines and EPC compliance, especially around:

- Complex batch file processing

- EDS connectivity

- Cross-border use cases

- Load balancing or scaling under pressure

With over 10 billion checks, 200+ banks, and national rollouts in countries like the Netherlands, Belgium, and soon Denmark, SurePay is not just a backup—it’s the most proven VOP platform in Europe.

Start today. Be sure who you pay.

Start today. Be sure who you pay.