Verification Of Payee: Strengthening Consumer Trust in Digital Payments

Instant payments are becoming the new normal within the EU following the EU Parment’s decision to require Payment Service Providers (PSPs) to offer their customers SEPA (Single Euro Payments Area) instant credit transfers.

Although they offer many benefits for businesses and consumers alike, instant payments also present new challenges in terms of security, particularly in relation to Authorised Push Payment (APP) fraud. In the UK, for example, fraud and scam cases reported to the UK’s Financial Ombudsman Service hit a record high in the second quarter of 2024, with APP fraud accounting for more than half of all reports

Verification Of Payee

The primary issues that VOP aims to address are:

- Increasing APP fraud: With the rise of digital payments, there has been a corresponding increase in fraud cases, particularly Authorised Push Payment fraud.

- Misdirected payments: VOP aims to reduce the occurrence of payments being sent to incorrect accounts due to errors in payee information.

- Payment delays: Potential errors in payee information are the most common cause of cross-border payment delays.

- Financial losses: Failed payments, often due to errors in payee information, cost the global economy an estimated $118.5 billion per year in fees, labour, and lost business.

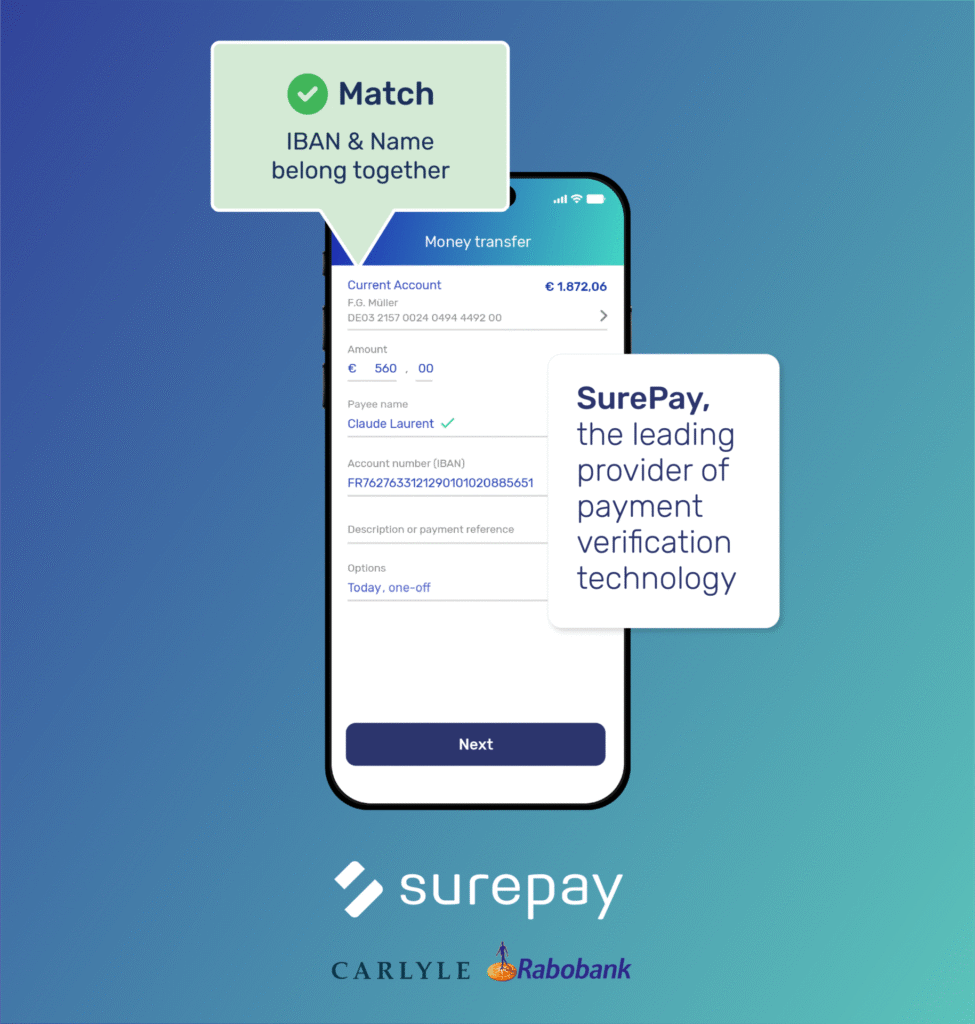

How Verification Of Payee works

- Initiation of payment: The sender begins the process of making a bank transfer through their chosen payment channel (e.g., online banking, mobile app).

- Entry of payee details: The sender enters the payee’s details, including account name and number (IBAN). Some jurisdictions require additional details such as a sort code.

- VOP request: The payee’s bank checks the provided information against their records and generates a response based on the matching results. This is done within three seconds and presents the VOP results to the sender.Depending on the VOP results, the sender will be presented with one of the following outcomes:

| What this means | Confidence level |

Exact match | The provided payee information matches the recipient’s bank records. | High — The sender can complete the payment with confidence. |

Close match | Minor discrepancies between the provided information and the bank records. | Medium — The sender is advised to double-check payee details. |

No match | The provided payee information does not match the bank records. | Low — The sender is advised to halt the transaction and verify payee details. |

Unavailable | The recipient’s bank doesn’t support VOP or cannot perform the verification. | Low — The sender is advised to proceed with caution and verify details via other means. |

Why Verification Of Payee matters

Verification Of Payee is not just a crucial security measure for fighting fraud and preventing misdirected payments. It’s also playing an increasingly important role in consumer trust and satisfaction.

By providing immediate feedback about the correctness of payment data, VOP improves user satisfaction and builds trust in SEPA account-to-account transfers. This increased confidence can lead to greater adoption of digital payment methods, which are cost-efficient, faster, and expand the market reach of consumers and businesses across Europe.

VOP also helps build consumer confidence in online banking. While many security measures focus on protecting against unauthorised access, VOP specifically targets the issue of payments being sent to the wrong recipient, whether due to fraud or error. This contributes to the overall trustworthiness of digital payment systems, which is crucial for the continued growth and adoption of online banking and digital payment methods.

VOP compliance challenges for PSPs

All SEPA PSPs are required to provide VOP by October 2025 for both SEPA instant and non-instant credit transfers. The implementation of VOP will require technical as well as non-technical efforts from both requesting and responding PSPs.

Requesting PSPs should enhance their payment channels so that customers can provide required VOP details such as the payee’s name and IBAN. Requesting PSPs must also be in a position to display the outcome of VOP and provide the customer with an option to proceed or terminate payment request, and to manage scenarios where recipient banks do not support VOP or there are discrepancies.

Responding PSP will need to make changes to their infrastructure to accept incoming VOP API requests and build name matching algorithms to instantly verify whether the received data matches the data registered for the payee in question and provide an API response back to the requesting PSP.

All PSPs should make efforts to educate their customers on what VOP is and how to correctly interpret VOP responses, such as:

- Always double-check payee details before confirming a payment.

- What to do in a “No Match” or “Close Match” scenario.

- Encouraging the use of banks that support VOP.

VOP is a joint responsibility

Verification Of Payee is a crucial tool in securing digital payments, helping to reduce fraud and misdirected payments. But its success depends on a partnership between banks and their customers. Banks, PSPs, and other financial institutions must ensure VOP systems are accurate, responsive, and clear, while also educating users on interpreting VOP results.

At the same time, customers have a role to play by staying vigilant: carefully reviewing payee information and understanding VOP alerts like “Close Match” or “No Match” before confirming transactions. As instant payments become the norm, this shared responsibility is essential for a safer, more trusted financial system.

Want to know more?

Schedule a meeting today

We are here to help answer any questions you may have about Verification Of Payee and the Instant Payments regulation.