Additional services

Additional verification services and enriched data points set SurePay apart, making us your invaluable partner for Verification Of Payee.

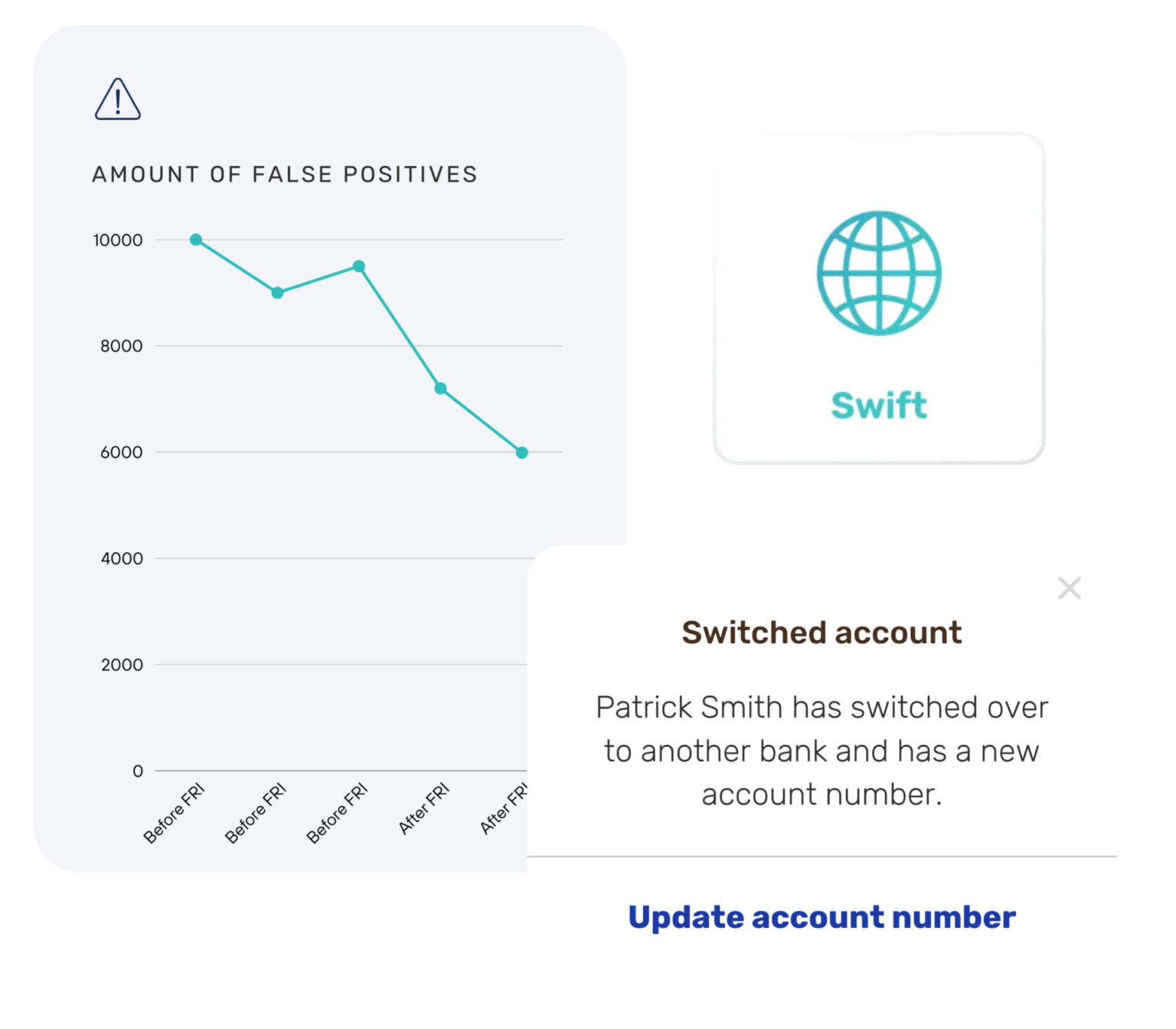

Lower false positives with our Fraud Risk Indicator

Expand your reach with our SWIFT Pre-Validation Service

Check bulk payments with our European Batch Check

Notify the payer when the payee switches banks with our Switch Check

Our additional services

Fraud Risk Indicator

The Fraud Risk Indicator provides additional data points; risk indicators that will help the bank to determine whether there’s an increased risk or a decreased risk of fraud.

Read More →

Read More →

Switch Check

If a bank uses the SurePay Switch Check, the payer will be notified when the payee has switched to another bank. This way he can immediately pay to the new IBAN and update his address book. This speeds up the adoption of new account numbers.

Read More →

Read More →

PayID

With SurePay PayID customers can now easily and securely pay in your Banking App to friends and acquaintances on their contact list. In the future we will add more identification options to this service. SurePay PayID uses the smart Verification Of Payee algorithm for this.

Read More →

Don't reinvent the wheel – Choose a VOP specialist for proven accuracy and security

Book a demo today for a explorary conversation, where we’ll guide you through the necessary steps to meet the implementation deadline with ease.

See how our solution works live, book a guided videocall with one of our experts.