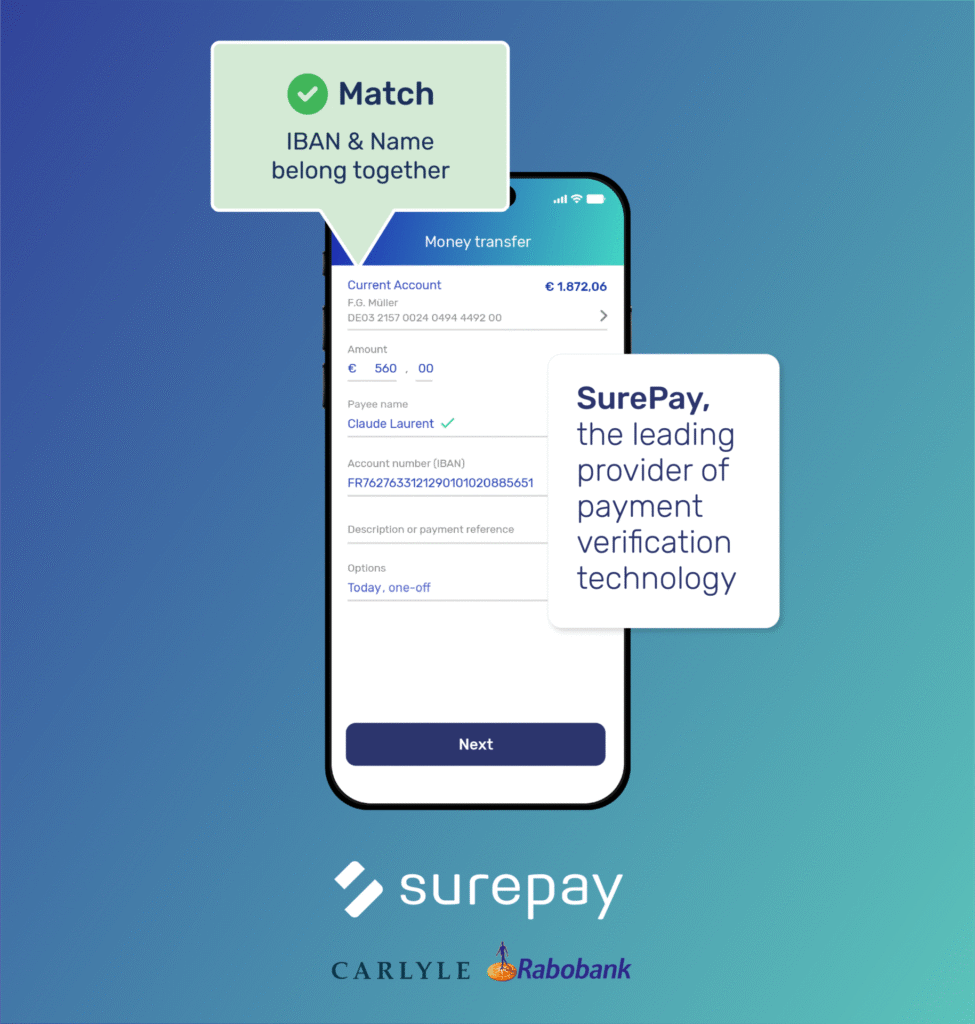

Elevating Bank Fraud Prevention with SurePay’s Innovative Solutions

Fraud and Authorised Push Payment (APP) scams are major concerns for the financial sector, with numerous news articles and reports indicating a rise in various online scams. The advent of the digital age has led to more sophisticated fraud tactics, where scammers employ social engineering and advanced impersonation techniques, including the use of AI and deepfake technologies. This situation highlights the critical need for more nuanced and effective countermeasures. Research conducted by Twente University, commissioned by the Dutch Banking Association (NVB) and published in 2022, reveals that losses in the Netherlands alone amounted to an estimated €2.75 billion.

In the relentless battle against financial fraud, banks have increasingly relied on sophisticated technological solutions to safeguard their operations and customers. The banking sector’s substantial investment in combating fraud underscores the necessity for even more refined approaches, given the continuously evolving nature of these fraudulent schemes.

Integration through a single API response

The integration of the Fraud Risk Indicator marks a strategic enhancement to our core service, providing banks with the trusted reliability of the Verification Of Payee and the advanced features of the Fraud Risk Indicator. By utilising this augmented service, banks can access comprehensive details on the beneficiary’s account through a single API response, enhancing their fraud detection systems. Given that the extension builds on an already implemented API, it is expected to require minimal technical effort from banks to adopt this enhancement.

The added value of Fraud Risk Indicator

The Fraud Risk Indicator features a modular setup, with the ‘Account Context’ module significantly reducing the occurrence of false positives in the bank’s fraud detection system. It provides insights into the context of the beneficiary’s account, such as its age, the number of account holders, and whether it is a business or personal account. In practice, banks employing this module have experienced substantial reductions in false positives, with decreases amounting to dozens of percentage points across various use cases. This reduces the strain on fraud analysts by minimising the time spent investigating false positives.

In addition to the Account Context module, Fraud Risk Indicator includes features that assess activity on the beneficiary account and cross-reference it with blacklists containing a vast number of domestic and foreign bank accounts implicated in scams. This enables the bank’s fraud detection system to identify additional instances of fraud. The modular setup offers a comprehensive approach, ensuring banks are well-equipped with the essential tools for more effective fraud detection and prevention.

In closing, as the financial landscape evolves, so too does the complexity of fraud schemes, making it imperative for banks to stay ahead with innovative and reliable solutions. SurePay’s commitment to enhancing bank fraud prevention through our Verification Of Payee and the Fraud Risk Indicator serves as a testament to our dedication to security and efficiency. We invite banks to explore how our technology can integrate seamlessly into their existing systems, offering a stronger, more resilient defence against the ever-changing tactics of fraudsters.