SurePay continues to grow as a Rabobank spin out

Starting as an innovative idea in 2015, SurePay has evolved into a healthy, growing company. A spin out from the Rabobank was a logical next step to continue growing as we do. As of February we are officially known as SurePay B.V. ‘By becoming a private limited company, SurePay will continue to grow as an independent service provider for financial institutions, (semi-)government, and other business and organisations in both the Netherlands and Europe.’ says David-Jan Janse, CEO and co-founder of SurePay, as he explains the spin out.

Development past years

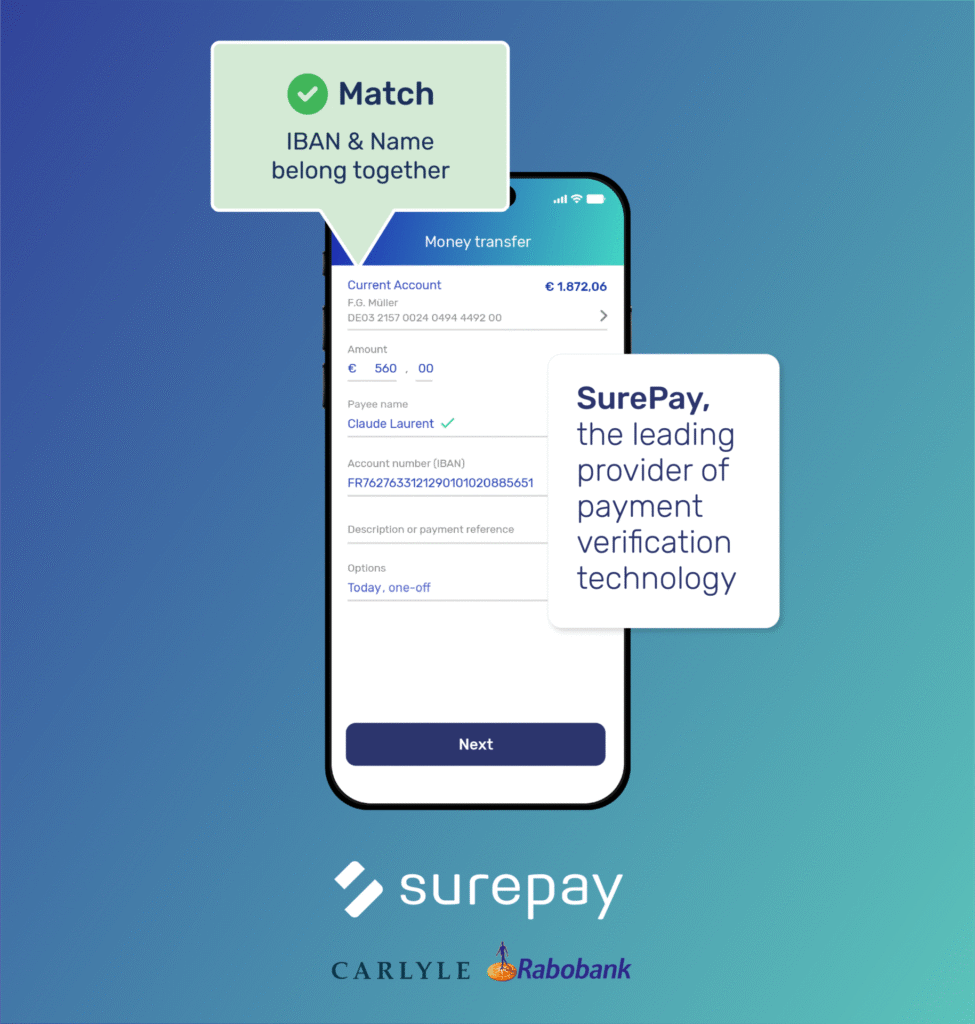

SurePay invented the IBAN-Name Check, with which now >90% of all online payments in the Netherlands are checked. This vastly improved the ease of use and security of online payments for consumers and businesses alike. Additionally, SurePay’s corporate customer base has grown to over 40 companies and organisations in the Netherlands. They apply the IBAN-Name Check, directly or via partners, to detect fraudulent or misdirected payments in their business processes. In 2019, over 1 billion online payments were checked by SurePay and more than 10 million checks were performed for businesses and organisations.

Successful corporate start-up

Harrie Vollaard, head of Rabo Frontier Ventures, which handles Rabobank’s strategic investments, says: ‘Security is high on the agenda for every company and investments in fintech are still on the rise. SurePay is perfectly positioned to take advantage of this sentiment. SurePay is proof that innovations from within our own organization can grow into a successful company. It all started with a great idea, that was encouraged to grow. We’re very proud to see SurePay evolve into an independent company now.’

Ambitions for growth in 2020 and beyond

As an independent partner we can provide even better advice and services to financial institutions, businesses, organisations and (semi-)government in the Netherlands, the United Kingdom and the rest of Europe. Our products and services will be adapted to local market demands. As an independent, we fully expect to fulfil our ambitions for further growth. ‘On the one hand, our ambitions encompass continuous growth for our account verification services, such as the IBAN-Name check and Confirmation of Payee. Additionally, we are on the brink of introducing additional innovative services to improve the security of online payments and detect fraudulent payments.’ says Marcel Rienties, co-founder and CPO.

Dorine van Basten, CCO of SurePay, says: ‘Due to our existing record of success in the Netherlands, we were approached by several financial institutions in the United Kingdom. As of March 2020, Confirmation of Payee will be in effect in the UK. This is a legal obligation to give end-users of payment systems greater assurance that they are sending money to the intended recipient. We have high hopes of our growth potential in the United Kingdom. As a vendor we are currently working closely with several financial institutions to implement Confirmation of Payee.’ SurePay’s solutions are fully compliant with the rules and regulations for Confirmation of Payee in the UK. We offer a range of services to payment service providers looking to implement Confirmation of Payee.