What to Expect from the Final PSD3 Legislation

What to expect from the Final PSD3 Legislation PSD3 is the European Union’s third Payment Services Directive. It is the successor to PSD2, and aims to make European payments even more secure, innovative and competitive.Read below the blog of Fraud Detection Strategist Wiebe Fokma, who discusses the expected PSD3 legislation. Five predictions on the final […]

An attempt to scam me in the Forbidden City ended with a slap in my face

An attempt to scam me in the Forbidden City ended with a slap in my face I travel the world helping banks prevent and detect online fraud and money laundering. But there are still old-fashioned physical scam artists in the real world. It was a few years ago that I took advantage of a 12-hour […]

Denmark becomes the first non-Euro country to implement a nationwide VOP solution

Denmark becomes the first non-Euro country to implement a nationwide VOP solution Finance Denmark selects SurePay for nation-wide Verification Of Payee services in Denmark Utrecht/Copenhagen, 24 April 2025 – Finance Denmark, the association representing banks, mortgage institutions and financial firms in Denmark, has selected SurePay to provide a national Verification Of Payee (VOP) service. With […]

How to cleverly combine EU fraud and money laundering laws for information sharing

How to cleverly combine EU fraud and money laundering laws for information sharing The EU is introducing two new regulations containing information sharing: the Payment Services Regulation (PSR) as part of PSD3 for fraud, and the Anti-Money Laundering Regulation (AMLR) for money laundering and terrorist financing. The PSD3 is currently being drafted, while the AMLR […]

The hidden risks in batch payments: Why EU banks need Verification Of Payee

The hidden risks in batch payments: Why EU banks need Verification Of Payee Imagine a multinational corporation processing payroll for thousands of employees. A single spreadsheet contains all the payment details, and the bank processes the batch in one go. But buried in that list, one IBAN is incorrect. The salary never reaches the employee. […]

SurePay and NatWest Group extend agreement for Confirmation of Payee

SurePay and NatWest Group extend agreement for Confirmation of Payee This renewal reflects the mutual trust, confidence, and value created through years of close collaboration. London/Utrecht, 14 January 2025 – SurePay is proud to announce the renewal of its agreement with NatWest Group, the first UK bank to implement SurePay’s Confirmation of Payee (CoP) solution […]

SurePay wins Banking Tech Award for Best Digital Solution PayTech

SurePay wins Banking Tech Award for Best Digital Solution PayTech A wonderful recognition for our VOP combined with value added services such as our Swift connection. SurePay is proud to announce its recognition as the Best Digital Solution Provider PayTech at the prestigious Banking Tech Awards. This is a huge recognition of our commitment […]

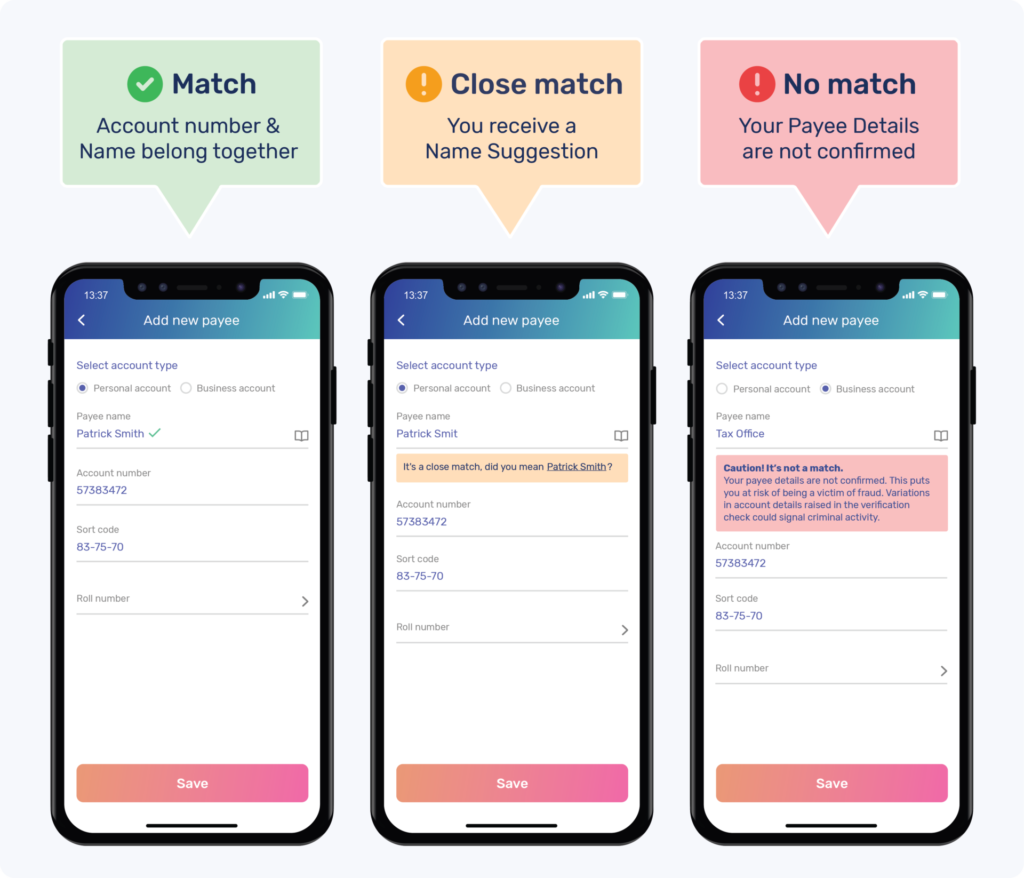

Verification Of Payee: Strengthening Consumer Trust in Digital Payments

Verification Of Payee: Strengthening Consumer Trust in Digital Payments Instant payments are becoming the new normal within the EU following the EU Parment’s decision to require Payment Service Providers (PSPs) to offer their customers SEPA (Single Euro Payments Area) instant credit transfers. Although they offer many benefits for businesses and consumers alike, instant payments also […]

How VOP and consumer awareness can help prevent APP fraud

How VOP and consumer awareness can help prevent APP fraud The role of consumer awareness in fraud prevention In April, the European Banking Authority (EBA) released an opinion highlighting the positive impact of PSD2 security measures, including strong customer authentication, across the European Union. The EBA noted that these requirements have been effective in preventing […]

Consider a Proof of Concept (PoC) for SurePay’s Verification Of Payee Solution.

Consider a Proof of Concept (PoC) for SurePay’s Verification Of Payee Solution Financial institutions are under increasing pressure to act swiftly due to the Instant Payments legislation. Payment Service Providers (PSPs) must balance the need to act quickly with the need to make the right decision, making the evaluation of Verification Of Payee solutions more […]