SurePay accelerates European VOP rollout: Belgium becomes first Eurozone country live with Verification Of Payee

Change language: French German Dutch SurePay accelerates European VOP rollout: Belgium becomes first Eurozone country live with Verification Of Payee Belgian banks are the first in the Eurozone to go live with Verification Of Payee (VOP), well ahead of the October 2025 deadline set by the EU Instant Payments Regulation. With this milestone, SurePay, Europe’s […]

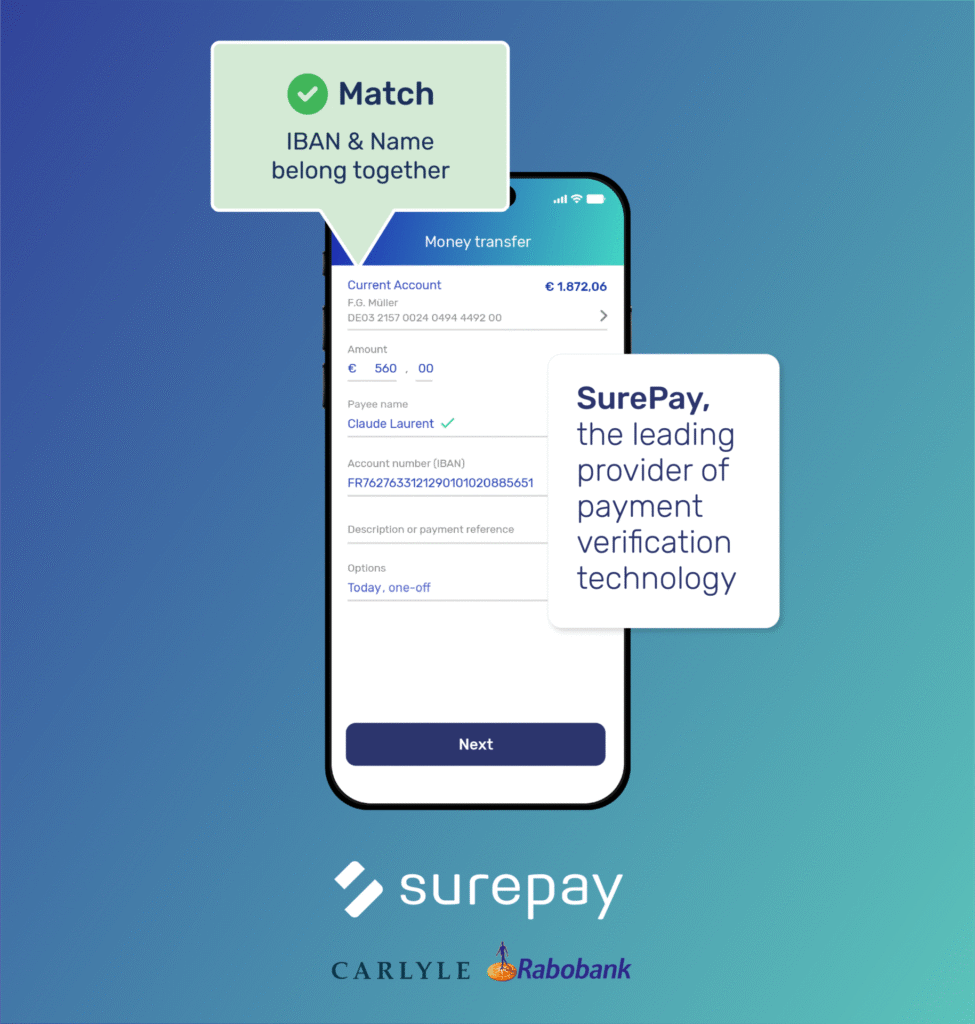

Carlyle Partners with Rabo Investments to Invest in SurePay

Carlyle Partners with Rabo Investments to Invest in SurePay Carlyle Europe Technology Partners (“CETP”), in partnership with Rabobank’s investment arm Rabo Investments, today announced a strategic growth investment in SurePay, a European leader in payment verification software. Founded within Rabobank in 2016 and headquartered in the Netherlands, SurePay is a leading provider of payment verification […]

What to Expect from the Final PSD3 Legislation

What to expect from the Final PSD3 Legislation PSD3 is the European Union’s third Payment Services Directive. It is the successor to PSD2, and aims to make European payments even more secure, innovative and competitive.Read below the blog of Fraud Detection Strategist Wiebe Fokma, who discusses the expected PSD3 legislation. Five predictions on the final […]

An attempt to scam me in the Forbidden City ended with a slap in my face

An attempt to scam me in the Forbidden City ended with a slap in my face I travel the world helping banks prevent and detect online fraud and money laundering. But there are still old-fashioned physical scam artists in the real world. It was a few years ago that I took advantage of a 12-hour […]

Denmark becomes the first non-Euro country to implement a nationwide VOP solution

Denmark becomes the first non-Euro country to implement a nationwide VOP solution Finance Denmark selects SurePay for nation-wide Verification Of Payee services in Denmark Utrecht/Copenhagen, 24 April 2025 – Finance Denmark, the association representing banks, mortgage institutions and financial firms in Denmark, has selected SurePay to provide a national Verification Of Payee (VOP) service. With […]

What is SurePay and How Does It Work?

What is SurePay and How Does It Work? In an era where digital transactions are the norm, ensuring payments reach the intended recipient is more critical than ever. SurePay is at the forefront of payment verification with its advanced Verification Of Payee (VOP) solution. Banks, businesses, and payment service providers across Europe rely on SurePay […]

How to cleverly combine EU fraud and money laundering laws for information sharing

How to cleverly combine EU fraud and money laundering laws for information sharing The EU is introducing two new regulations containing information sharing: the Payment Services Regulation (PSR) as part of PSD3 for fraud, and the Anti-Money Laundering Regulation (AMLR) for money laundering and terrorist financing. The PSD3 is currently being drafted, while the AMLR […]

The hidden risks in batch payments: Why EU banks need Verification Of Payee

The hidden risks in batch payments: Why EU banks need Verification Of Payee Imagine a multinational corporation processing payroll for thousands of employees. A single spreadsheet contains all the payment details, and the bank processes the batch in one go. But buried in that list, one IBAN is incorrect. The salary never reaches the employee. […]

How Bank Account Verification is the key to compliant & safe Instant Payments

How Bank Account Verification is the key to compliant & safe Instant Payments Real-time payments are transforming the banking industry, but they come with unique challenges: how can banks ensure that money reaches the right recipient instantly, securely, and without error? For financial institutions navigating the EU’s Instant Payments Regulation, the stakes are high. Fraud […]

SurePay and NatWest Group extend agreement for Confirmation of Payee

SurePay and NatWest Group extend agreement for Confirmation of Payee This renewal reflects the mutual trust, confidence, and value created through years of close collaboration. London/Utrecht, 14 January 2025 – SurePay is proud to announce the renewal of its agreement with NatWest Group, the first UK bank to implement SurePay’s Confirmation of Payee (CoP) solution […]