How Bank Account Verification is the key to compliant & safe Instant Payments

Real-time payments are transforming the banking industry, but they come with unique challenges: how can banks ensure that money reaches the right recipient instantly, securely, and without error? For financial institutions navigating the EU’s Instant Payments Regulation, the stakes are high. Fraud prevention, compliance, and customer trust are no longer just goals—they’re requirements.

Bank account verification, particularly through Verification Of Payee (VOP), is the key to solving these challenges. It ensures that payments are accurate, secure, and compliant with the 2025 regulation. In this blog, we’ll break down what bank account verification is, why it matters, and how SurePay’s solutions can simplify compliance while reducing fraud and operational costs.

What is Bank Account Verification?

Bank account verification is the process of ensuring that the details provided during a payment—such as the payee’s name and bank account number—are accurate and match the information registered with the recipient’s bank. This crucial step is designed to confirm the legitimacy of the payee and reduce the risks associated with fraud or payment errors.

Crucial in Instant Payments

Bank account verification plays a pivotal role in modern payment systems, particularly with the rise of real-time transactions through Instant Payments. It ensures that money reaches the intended recipient securely and without unnecessary delays or mistakes. By validating key account details before a transaction is completed, banks and payment service providers (PSPs) can build trust, enhance customer experience, and reduce operational costs.

How it works: Verification Of Payee (VOP)

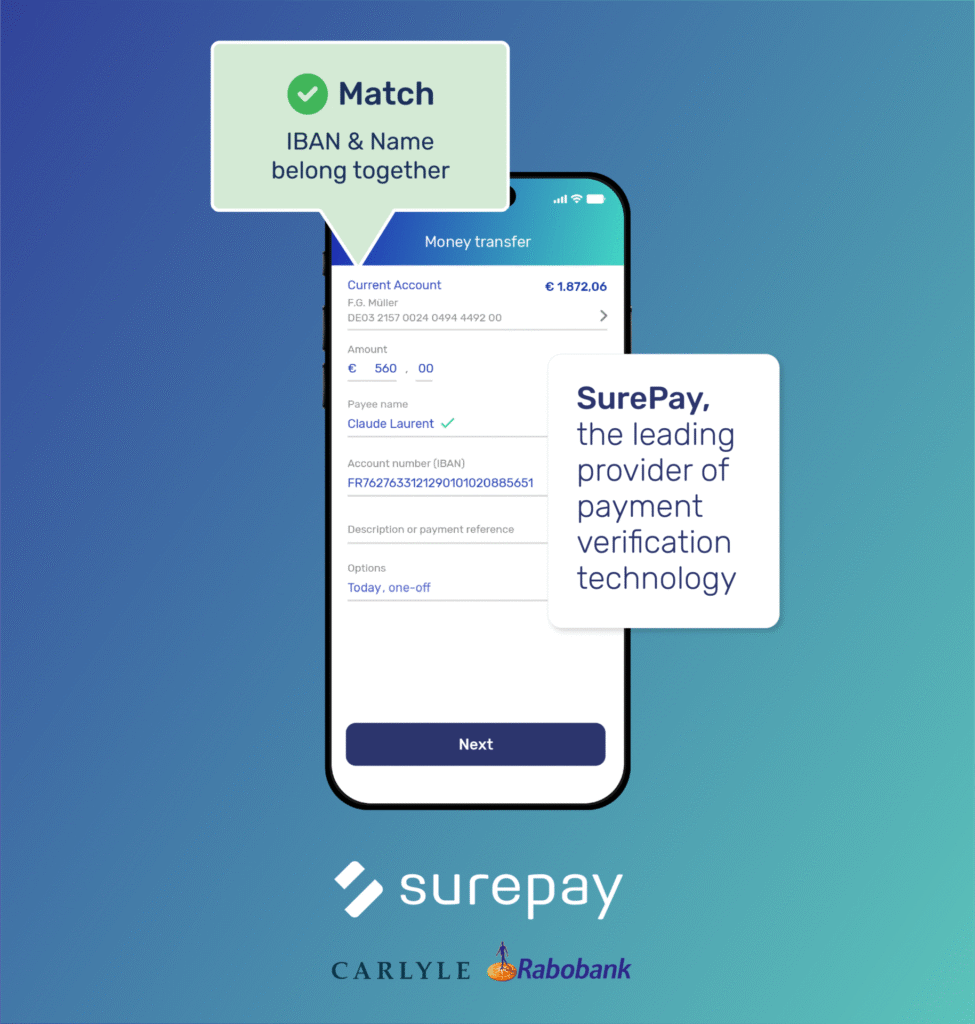

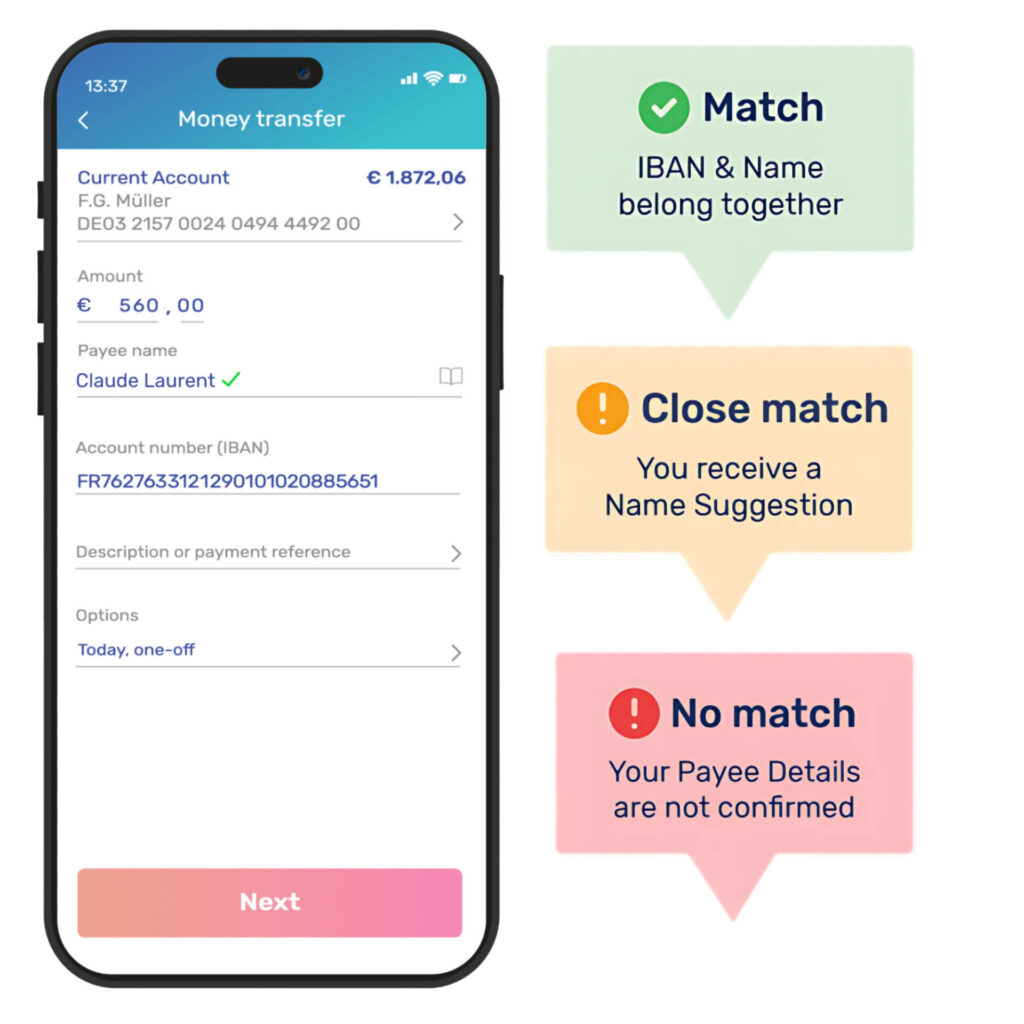

In the European payments landscape, Verification Of Payee is the standard for bank account verification. It works by cross-checking the payee’s name provided by the payer with the name registered to the recipient’s account. The system then provides one of three outcomes:

- Match: The name aligns with the account number, and the payment proceeds.

- Close Match: A minor discrepancy is detected (e.g., a typo), prompting the payer to review the details.

- No Match: The name and account number don’t align, alerting the payer to a potential issue.

VOP is more than a technical requirement—it’s a critical safeguard for protecting both consumers and banks from unauthorised payments and errors. By ensuring payee details are correct, VOP strengthens the overall integrity of payment systems and aligns with the broader goals of the EU’s Instant Payments Regulation.

Why is Bank Account Verification important for banks?

Bank account verification is not just a nice-to-have feature; it’s a critical enabler of secure and compliant payment processes. As fraud risks rise and real-time payments become mandatory under the EU’s Instant Payments legislation, banks must prioritise accuracy and security in transactions. Here’s why it matters for banks:

1. Preventing fraud & errors

Verification ensures payments go to the intended recipient, reducing:

- Fraudulent activity, like unauthorised push payments (APP).

- Mistakes caused by incorrect account details.

2. Ensuring compliance

The EU Instant Payments Regulation requires measures like Verification Of Payee (VOP) for real-time payments. Banks must:

- Meet the 2025 compliance deadline.

- Avoid fines and liability.

- Align with regulatory standards.

3. Building customer trust

Accurate payments enhance confidence in banking services. Verification helps:

- Offer error-free transactions.

- Reduce payment issues and customer complaints.

- Boost satisfaction and loyalty.

4. Lowering operational costs

Preventing payment errors reduces:

- Costly disputes and reversals.

- Customer support inquiries.

- Operational inefficiencies.

5. Staying competitive

Real-time payments are the new standard. Verification helps:

- Improve payment reliability.

- Build trust as a secure, compliant partner.

- Maintain a competitive edge.

The EU Instant Payments Legislation and its impact on Bank Account Verification

The EU Instant Payments Regulation (IPR) is set to revolutionise the way financial institutions handle payments across Europe. By 2025, all banks in the EU will be required to offer real-time payment services, ensuring funds are transferred instantly, 24/7. This legislation introduces new compliance requirements, with Verification Of Payee playing a key role in securing transactions and preventing fraud.

If you want to know more about what the regulation requires, and what the practical implications and benefits are for banks, have a look at our blog Understanding the EU Instant Payments Regulation (IRP).

Why choose SurePay for Bank Account Verification?

As the leading provider of VOP solutions in Europe, SurePay has built a trusted reputation for delivering secure, efficient, and compliant payment systems. With over 200 banks already using our platform, we are uniquely positioned to help your institution meet the challenges of real-time payments and regulatory compliance.

1. Proven Expertise and Track Record

SurePay has been at the forefront of bank account verification for over 7 years, supporting:

- 200+ banks across Europe.

- Millions of secure transactions daily, with unmatched reliability.

Our deep expertise ensures seamless implementation and smooth integration into your existing systems.

2. Advanced and Accurate Algorithm

SurePay’s algorithm goes beyond standard verification, offering:

- High-accuracy matching to reduce false negatives and unnecessary rejections.

- Detailed no-match feedback, such as identifying whether a mismatch is due to typos or account type differences (e.g., personal vs. business accounts).

- Improved customer experience by providing clarity and reducing confusion in transaction processes.

3. Fully Compliant with EU Instant Payments Regulation

Our VOP solution is fully aligned with the European Payments Council (EPC) Rulebook, ensuring your bank meets all regulatory requirements, including:

- Real-time responses for Instant Payments.

- Support for batch payments and seamless interoperability with the EPC Directory Service.

By choosing SurePay, you can rest assured your institution is ready for the 2025 compliance deadline.

4. Seamless Integration and Scalability

SurePay’s solution is designed to integrate effortlessly with your existing payment infrastructure, offering:

- Quick implementation with minimal disruption to operations.

- Scalability to handle growing transaction volumes, whether domestic or cross-border.

- Compatibility with multiple payment schemes, including SEPA and SWIFT.

5. Cost Savings and Fraud Reduction

By verifying payee details before transactions are processed, SurePay helps your bank:

- Prevent unauthorised push payment (APP) fraud.

- Reduce customer inquiries and disputes caused by payment errors.

- Save time and resources, lowering operational costs.

6. Trusted by Leading Banks

SurePay is already the go-to provider for many of Europe’s top financial institutions. In the Netherlands, for example, 99.9% of all bank accounts are covered by SurePay’s VOP solution, making us a trusted partner in securing payments and ensuring compliance.

Conclusion: A partner you can rely on

Choosing SurePay means partnering with an industry leader that combines innovation, reliability, and compliance. Our solutions not only meet today’s regulatory requirements but also future-proof your payment systems against evolving challenges.

Next steps: Preparing for Instant Payments compliance

With the 2025 compliance deadline approaching, now is the time to act. Start by assessing your systems for real-time payment readiness and VOP integration. Choose a reliable VOP provider like SurePay to ensure seamless compliance with EU regulations, including batch processing and interoperability. Upgrade your infrastructure to handle 24/7 operations securely and train your teams to manage the changes effectively. Finally, communicate the benefits of these updates to your customers to build trust and encourage adoption.

Act now to ensure compliance, enhance security, and position your bank as a leader in real-time payments.

Secure your compliance today

The future of payments is here, and compliance with the EU Instant Payments Regulation is not optional—it’s essential. Verification Of Payee is a critical component of this transformation, ensuring secure, accurate, and real-time payments while protecting against fraud and errors.

At SurePay, we specialise in helping banks seamlessly implement VOP solutions that meet and exceed regulatory requirements. With our proven track record of supporting over 200 banks across Europe, our scalable, accurate, and fully compliant platform is the trusted choice for financial institutions preparing for 2025.

Don’t let the 2025 deadline catch you off guard. Partner with SurePay today and lead the way in secure, compliant payments.

Want to know more?

Best in class Verification Of Payee solution

Download our whitepaper

Find your answers in our latest whitepaper: “Connecting Europe through Verification Of Payee”