Why countries choose a national VOP Scheme — And why that matters

- Back to overview

- Utrecht

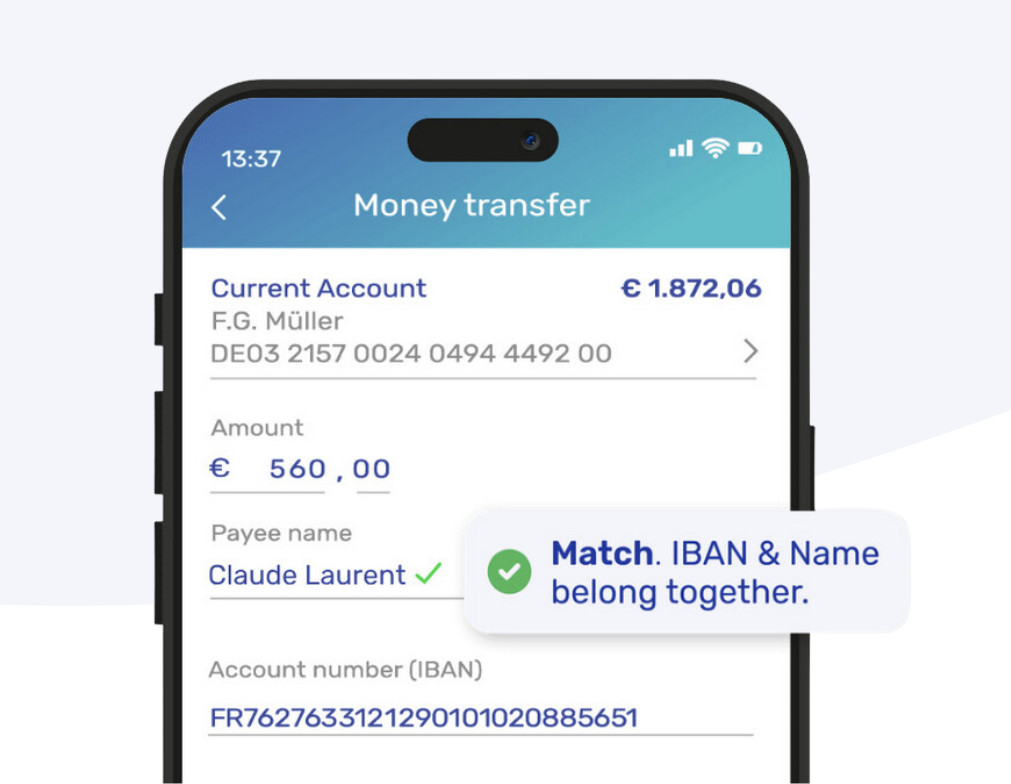

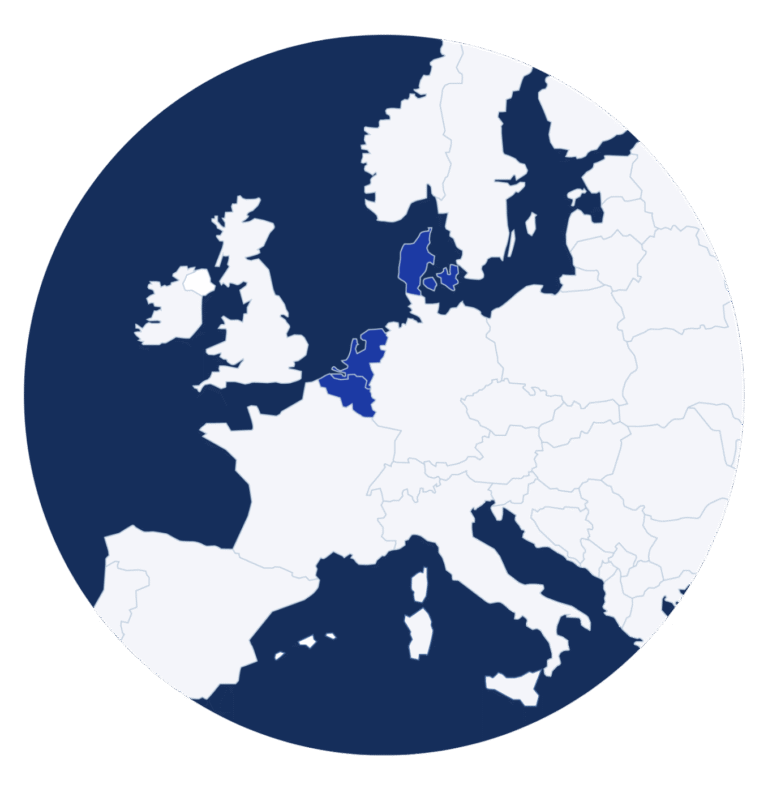

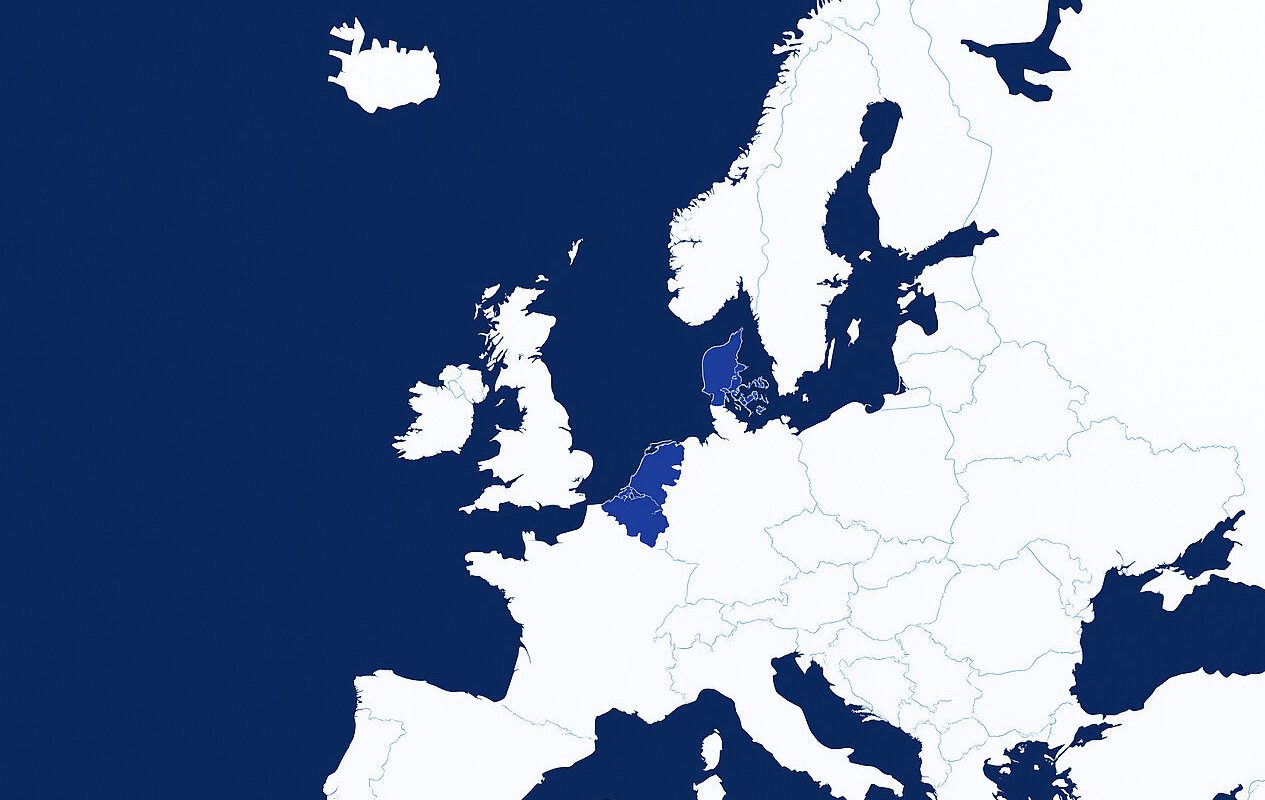

As the July 2027 deadline for the non-Euro EU’s Instant Payments Regulation (IPR) approaches, countries across Europe are making strategic decisions about how to implement Verification Of Payee (VOP). While some nations choose to let banks and PSPs decide individually, others—like the Netherlands, Belgium and Denmark—have opted for a national scheme.

But why does a centralised approach make sense? And what lessons can be drawn by countries still exploring their path?

One solution, nationwide trust

In the Netherlands, the IBAN-Name Check was introduced in 2017 as a national initiative. Today, 99.9% of all Dutch bank accounts are covered by SurePay, making payee verification a seamless, trusted experience for users and institutions alike.

Belgium and Denmark followed suit, selecting SurePay as their nationwide VOP provider. This not only ensures fast compliance with the Instant Payments Regulation, but also sets the bar higher: these country-wide schemes include enhanced VOP features, such as:

- More data sources for better match rates

- Advanced fraud mitigation like the Fraud Risk Indicator

- Language localisation, such as trilingual support in Belgium

- Solutions tailored for business payments

The power of a coordinated rollout

Consistent verification, collective trust

A centralised VOP implementation does more than streamline compliance—it creates trust. When every bank in a domestic scheme applies the same high-accuracy name matching algorithm, users receive consistent messages across all payment channels. This shared infrastructure ensures a uniform experience, enabling PSPs to jointly define their risk appetite and act decisively in fraud prevention.

Unlike fragmented approaches—where each PSP interprets name matching differently—a national or scheme-wide solution removes uncertainty. It avoids the confusion consumers currently face in markets like the UK, where outcomes can differ depending on which bank initiates the check.

Fraud Risk Indicator and law enforcement data

Trust doesn’t stop at matching. SurePay goes further with its Fraud Risk Indicator (FRI)—an integrated module that flags suspicious accounts based on behavioural patterns and shared fraud data. In the Netherlands, SurePay partners with law enforcement to enhance FRI insights using police-reported fraud cases. This real-time intelligence empowers banks to act before fraud occurs, not after.

What is the value of FRI?

- Provides additional datapoints for your Transaction Monitoring

- Helps to identify increased or decreased risk for fraud and money laundering

- Lowers the number of false positives and lowers operational costs

- Allows for more focus on actual fraud cases

Combining consistent VOP results with proactive fraud signalling strengthens the entire payment ecosystem.

What about other mandated countries?

Not every country will opt for a national scheme. Some, especially those with smaller banking ecosystems or strong regional alliances, may band together and are considering a shared regional implementation.

In these cases, it becomes essential to select a partner with cross-border capabilities and proven scale. This is where SurePay stands out: with more than 250 financial institutions across Europe, including UK-wide CoP and integration with Swift’s Payment Pre-validation, SurePay is already the backbone of many domestic and international VOP networks.

If you’re getting the same compliance and performance… why not choose the most trusted provider?

A trigger for the rest

The rise of country schemes also raises the bar for those going it alone. If Belgium or Denmark can offer enriched, accurate, and fraud-aware VOP to their customers nationally, what’s stopping others?

In fact, we increasingly see individual banks in countries without a national rollout turning to SurePay to match or exceed that level of security—whether as their primary provider, or as a fallback for in-house or limited solutions.

Conclusion:

The choice to go national is not just about compliance—it’s about trust, scale, and security. Whether you are a country regulator, a banking association, or a PSP exploring your VOP strategy, one thing is clear: with the right technology and partner, the national approach is not just possible—it’s a competitive advantage.

1.

Trust

One of the strongest arguments for a national VOP scheme is the uniform payment experience it creates for consumers and businesses. Whether someone banks with a large player or a smaller player, the Verification of Payee logic and user experience are the same. This consistency builds trust at scale.

It also ensures that fraud prevention becomes a shared responsibility, not an isolated effort. When all market players operate on the same VOP infrastructure, the country collectively raises the bar for what “safe payments” look like.

2.

Tailored risk appetite

Every country — and even every banking community — has a different risk appetite.

A national VOP scheme allows for calibrating the matching algorithm and response behavior in line with that appetite. For example:

- How should the system treat initials, abbreviations, or company trading names?

- What level of certainty is acceptable before flagging a transaction?

- The use of other identifiers

These choices are critical. When VOP is tuned to reflect national preferences and legal context, it not only becomes more effective — it also avoids unnecessary customer frustration. It’s this balance between security and user experience that defines a successful rollout.

3.

Algorithms That Fit the Local Context

Beyond risk appetite, countries differ in language, legal naming structures, and payment behavior. A national VOP scheme allows for context-aware algorithms that go beyond literal name checks. These may account for:

- Common naming conventions (e.g., initials, joint accounts)

- Multilingual inputs (accents, special characters)

- Business identifiers vs. commercial names

By localising the algorithm, national schemes reduce false positives and enable more precise fraud detection — while still offering a seamless user experience.

This full solution can be offered fully SAAS based or Hybrid including blocks on premise in case these are standard on a domestic level.

Want to know more?

Best in class Verification Of Payee solution

With our European Verification Of Payee solution, the combination of IBAN & Name will be checked in EU countries, the UK and the world.

Schedule a meeting today

We are here to help answer any questions you may have about Verification Of Payee and the instant payments regulation.