Verification Of Payee and Liability: Ensuring secure Instant Payments

The European Council has recently adopted regulations to make Instant Payments available for euro transactions across the EU and EEA countries. This regulation allows consumers and businesses to transfer money within ten seconds, any time of the day, even outside business hours, and across borders within the EU.

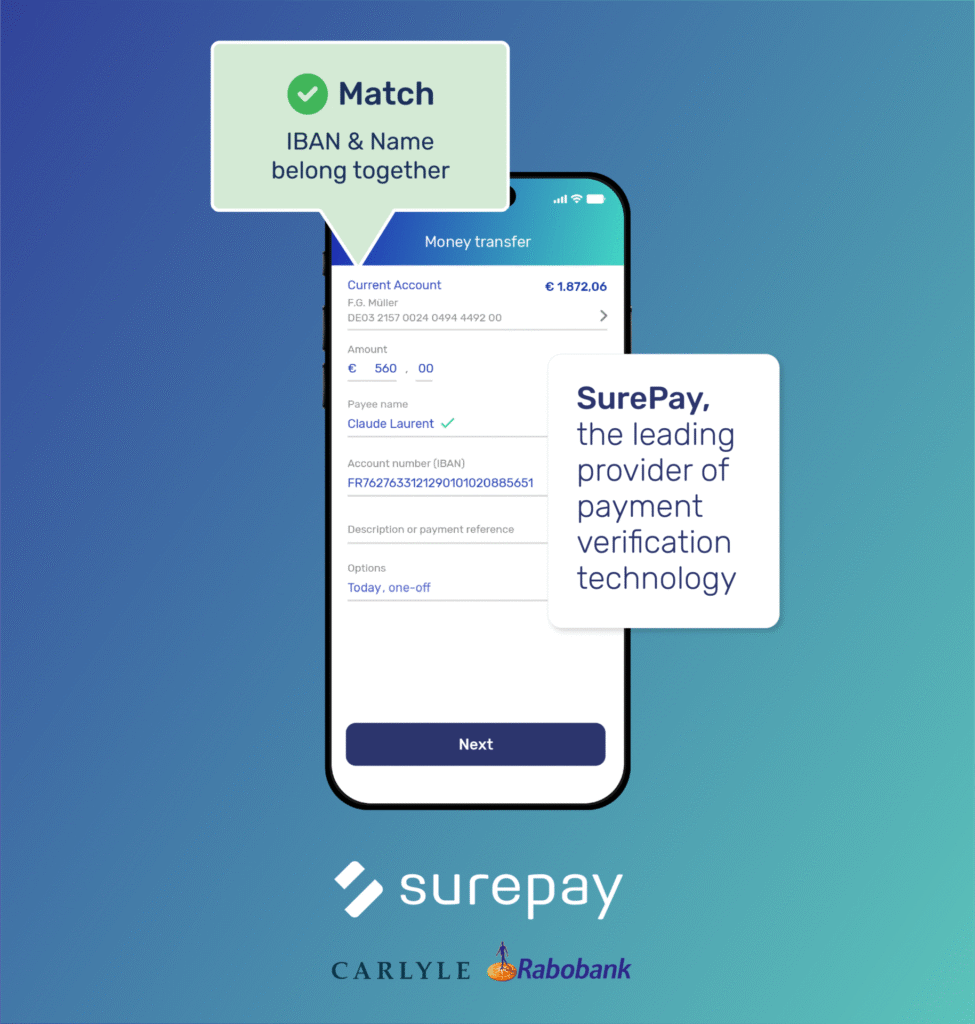

A crucial component of this regulation is the Verification Of Payee (VOP) mandate. Under the new rules, instant payment providers must verify that the beneficiary’s International Bank Account Number (IBAN) and name match. This verification aims to alert the payer to possible mistakes or fraud before a transaction is executed, thereby enhancing security and trust in the payment process.

Quality and Proven Solutions

When it comes to choosing a Verification Of Payee provider, the quality and reliability of the solution are crucial. SurePay is a pioneer in the Verification Of Payee service, operational since 2016 and live in multiple countries, with over 7 billion checks conducted. Our continuously improving algorithms ensure high accuracy and efficiency, making us a reliable partner for banks and Payment Service Providers (PSPs).

The outcome of our Verification Of Payee checks are presented back as one of three possible results:

- Match: The entered IBAN and name match. The customer receives a notification indicating the details are correct.

- Close Match: The name entered differs slightly from the name associated with the IBAN. The customer receives a notification with a clickable name suggestion to correct the details automatically.

- No Match: The name entered does not match the IBAN. The customer receives an error notification and can cancel the payment to review the data.

This system helps protect end users against fraud and misdirected payments, ensuring the integrity of transactions.

What is liability and why is it important?

In the context of Verification Of Payee, liability refers to the legal responsibility that banks and Payment Service Providers (PSPs) have for ensuring the accuracy and security of payment transactions. The Instant Payments Regulation outlines the liability framework for participants in the VOP scheme. The key points, which are mentioned in article 5c of the Instant Payments regulation, include:

- Refund and account restoration for incorrect transactions: If the payer’s PSP or a payment initiation service provider fails to meet the article’s requirements, leading to an incorrect transaction, the payer’s PSP must promptly refund the payer and restore the account.

- Liability exemption for incorrect transfers due to unique identifier errors: A PSP shall not be held liable for the execution of a credit transfer to an unintended payee on the basis of an incorrect unique identifier

- Liability of payee PSP for failing to verify IBAN and Name Match: A PSP is liable if it fails to meet its obligation under the article (providing a response on whether the IBAN and name match).

To avoid liability, banks and PSPs must take proactive measures:

- Offer Verification Of Payee service: Ensure that the VOP service is available to customers across all channels where instant and credit transfers are executed.

- Be reachable for VOP requests: Respond to incoming VOP requests promptly and accurately.

- Provide correct Match results: Ensure that the match results (Match, Close Match, No Match) are accurate to prevent erroneous or fraudulent transactions.

- Implement a best-in-Class VOP solution: Utilise a VOP system that minimises false positives and false negatives, complies with GDPR, and provides clear, actionable messages to users.

- Stay updated: Regularly update the matching algorithm to include country-specific details, synonyms, and known nicknames to enhance accuracy.

How will Verification Of Payee contribute to avoid being liable?

The Verification Of Payee service is a critical tool in enhancing the security and accuracy of Instant Payments. By implementing an effective VOP system, banks and PSPs can significantly reduce the risk of fraud and misdirected payments, thereby minimising their liability.

SurePay’s experience in working with local and global partners also ensures smooth integration with your existing systems. This capability is crucial as it allows for smooth transitions and cooperation with parties your institution is already familiar with. Partnering with a provider adept in handling diverse integration scenarios guarantees a more efficient and less disruptive implementation process.