VOP: Key Lessons Learned According to the CTO

VOP: Key Lessons Learned According to the CTO Verification of Payee is a banking service that verifies whether the name of the beneficiary matches the IBAN provided by the payer before a payment is authorized. It is designed to combat Authorized Push Payment (APP) fraud (where fraudsters trick victims into sending money) and to prevent […]

How Fraud detection in the “Wild West” era was superior

How Fraud detection in the “Wild West” era was superior I started detecting online banking fraud back in 2011. It was at the time that the Netherlands suffered under a huge peak in online banking fraud, especially malware that injected large numbers of fraudulent transactions. As the newly installed detection system came without any detection […]

How Bank Account Verification is the key to compliant & safe Instant Payments

How Bank Account Verification is the key to compliant & safe Instant Payments Real-time payments are transforming the banking industry, but they come with unique challenges: how can banks ensure that money reaches the right recipient instantly, securely, and without error? For financial institutions navigating the EU’s Instant Payments Regulation, the stakes are high. Fraud […]

Understanding IBAN-Name Check: What It Is and Why It Matters

Understanding IBAN-Name Check: What It Is and Why It Matters With payment fraud on the rise and financial errors costing millions annually, ensuring secure and accurate transactions has never been more important. While the names may vary—IBAN-Name Check, Verification Of Payee (VOP), or Confirmation Of Payee (COP)—they all serve the same critical purpose: verifying account […]

Verification Of Payee in the EU: What it is, how it works, and how to prepare

Verification Of Payee in the EU: What it is, how it works, and how to prepare As of October 2025, Verification of Payee (VOP) has become a mandatory requirement for banks and payment service providers operating within the euro area.This milestone marks a major step toward safer, more transparent Instant Payments across Europe — helping […]

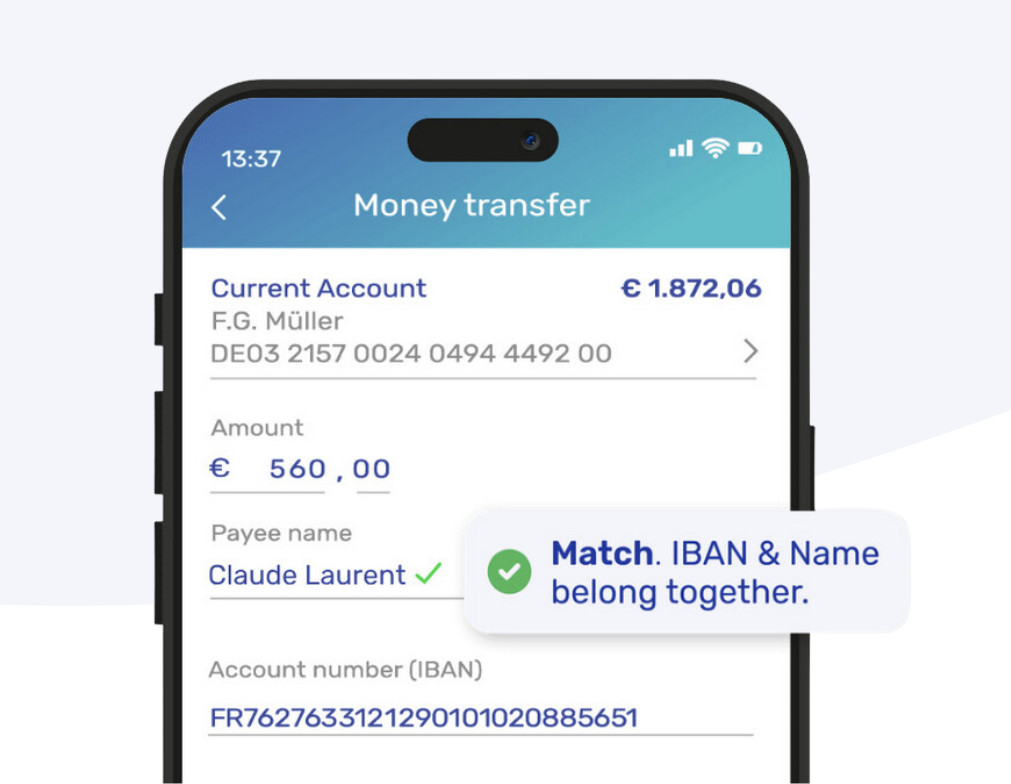

What is SurePay and How Does It Work?

What is SurePay and How Does It Work? In an era where digital transactions are the norm, ensuring payments reach the intended recipient is more critical than ever. SurePay is at the forefront of payment verification with its advanced Verification Of Payee (VOP) solution. Banks, businesses, and payment service providers across Europe rely on SurePay […]

Understanding the EU Instant Payments Regulation (IPR): What banks need to know

Understanding the EU Instant Payments Regulation (IPR): What banks need to know The EU Instant Payments Regulation (IPR) is set to transform the European payments landscape by making instant payments a mandatory standard for all financial institutions by 2025. This regulation mandates that payment services must be available 24/7, processed in real time, and as […]

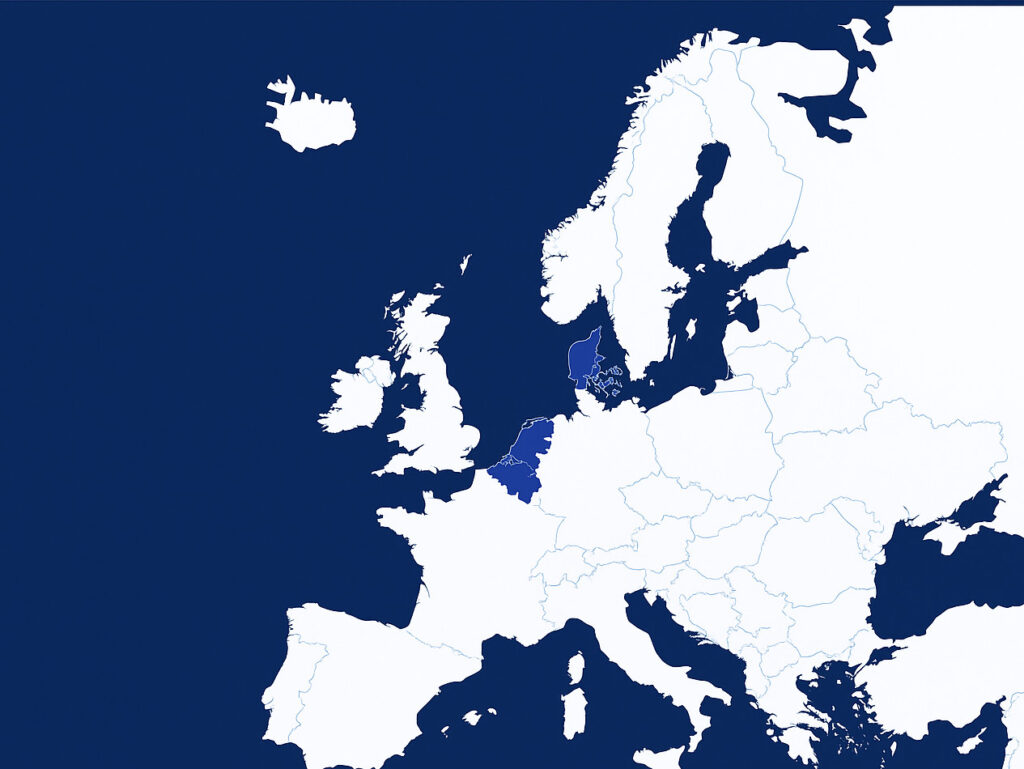

Why countries choose a national VOP Scheme – And why that matters

Why countries choose a national VOP Scheme — And why that matters As the July 2027 deadline for the non-Euro EU’s Instant Payments Regulation (IPR) approaches, countries across Europe are making strategic decisions about how to implement Verification Of Payee (VOP). While some nations choose to let banks and PSPs decide individually, others—like the Netherlands, […]

SurePay accelerates European VOP rollout: Belgium becomes first Eurozone country live with Verification Of Payee

Change language: French German Dutch SurePay accelerates European VOP rollout: Belgium becomes first Eurozone country live with Verification Of Payee Belgian banks were among the first in the Eurozone to go live with Verification Of Payee (VOP), well ahead of the October 2025 deadline set by the EU Instant Payments Regulation.With this milestone, SurePay — […]

Carlyle Partners with Rabo Investments to Invest in SurePay

Carlyle Partners with Rabo Investments to Invest in SurePay Carlyle Europe Technology Partners (“CETP”), in partnership with Rabobank’s investment arm Rabo Investments, today announced a strategic growth investment in SurePay, a European leader in payment verification software. Founded within Rabobank in 2016 and headquartered in the Netherlands, SurePay is a leading provider of payment verification […]